|

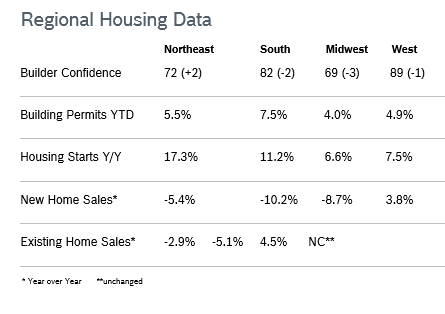

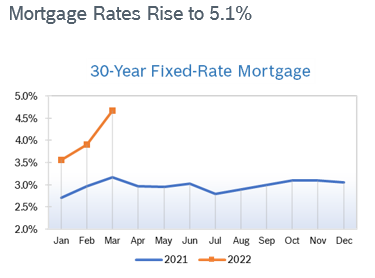

Builder Confidence Falls to 77 Builder confidence fell two points to 77 in April after falling to 79 in March, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). It was the fourth consecutive month the HMI has declined after hitting an all-time high of 90 last November. Sales traffic and current conditions have dropped to their lowest point since last summer as rising mortgage rates and persistent supply chain and labor problems squeeze the market. The HMI index gauging current sales conditions fell two points to 85. The index measuring sales expectations in the next six months rose three points to 73 after plunging 10 points in March. Regional scores remained mixed. Any number over 50 indicates that more builders view the component as good than view it as poor. Building Permits Rise 0.4% Overall permits rose 0.4% in March to 1.87 million annual units after falling to 1.86 million units in February. Single-family permits fell 4.8% to 1.15 million units after being essentially flat in February. Multifamily permits rose 10% to 726,000 annual units after dropping to 652,000 units in February. There are now 149,000 single-family homes that have been permitted but are not yet under construction, up 14.6% year over year as rising costs and materials shortages delay starts. Regional permits were mixed year to date. Housing Starts Rise 0.3% Housing starts inched up 0.3% in March to a seasonally adjusted 1.79 million units after rising sharply to 1.77 million units in February. Single-family starts fell 1.7% to 1.20 million units after rising to 1.22 million units in February. Multifamily starts rose 4.6% to 593,000 units after rising to 554,000 units in February. Regional starts were mixed. NAHB says supply chain disruptions need to be resolved so builders can increase production and contain costs. Rising costs and climbing mortgage rates are making housing less affordable and pricing more first-time buyers out of the market. New Home Sales Fall 8.6% New home sales dropped 8.6% in March to a seasonally adjusted annual rate of 763,000 homes after home sales for February were revised up to 835,000 homes. Sales were down 12.6% from March 2021. The median new home price jumped 21.4% from a year ago to $436,700. Strong price growth is expected to persist through this year and into 2023. There were 407,000 new homes on the market, up about 20,000 units from February. Houses under construction made up 65.5% of the inventory, with homes yet to be built accounting for about 25.8%. Sales fell in all regions. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously-owned homes, which are calculated when a contract closes. Existing Home Sales Fall 2.7% Existing home sales fell 2.7% in March to a seasonally adjusted annual rate of 5.77 million units after falling to 6.02 million units in February, according to the National Association of Realtors. Sales were down 4.5% from March 2021. The inventory of unsold existing homes increased to 900,000 homes after falling to an all-time low of 860,000 homes in January. There was a 2.0 months’ supply of homes at the current sales pace, up from 1.7 months in February. The median existing-home sales price was up 15.0% year over year to $375,300. Year-over-year prices have risen for 120 consecutive months. Properties were on the market for an average of just 18 days in March, with homes priced under $500,000 being snapped up in even less time. Regional existing home sales were mixed. Remodeling Index Steady The National Association of Home Builders (NAHB)/Westlake Royal Remodeling Market Index (RMI) held steady at 86 for the first quarter, compared Q1 2021. NAHB says the index reading shows that residential remodelers remain confident that there is demand for projects of all sizes. However, some consumers are weary of climbing prices and long delays and are postponing projects. The Current Conditions Index averaged 89, unchanged from Q1 2021.The component measuring large remodeling projects ($50,000 or more) rose four points to 89. The component measuring moderately-sized remodeling projects (at least $20,000 but less than $50,000) fell one point to 89, and the component measuring small remodeling projects (under $20,000) dropped two points to 90. The Future Indicators Index edged down two points to 82. The component measuring leads and inquiries fell six points to 80, and the backlog of remodeling jobs rose two points to 84.

© Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|