|

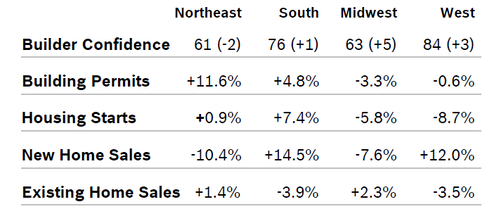

Builder Confidence Rises to 76 Builder confidence rose five points to 76 in December after dropping to 70 in November, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). It was the highest reading since June 1999. The strong labor market, low mortgage rates and a shortage of existing homes are all fueling the housing rebound. All three HMI components registered gains in December. The HMI index gauging current sales conditions rose seven points to 84, the component measuring sales expectations in the next six months edged up one point to 79 and buyer traffic rose four points to 58. Builder Confidence rose in all regions except the Northeast. Building Permits Rise 1.4% Building permits rose 1.4% in November to a seasonally adjusted annual rate of 1.48 million units after rising to 1.46 million in October. Single-family permits rose 0.8% to 918,000 annual units and multifamily permits rose 2.5% to 564,000 annual units. Regional permits were mixed. Housing Starts Rise 3.2% Housing starts rose 3.2% in November to a seasonally adjusted annual rate of 1.37 million units after rising to 1.31 million units in October. Single-family starts increased 2.4% to 938,000 units after starts for October were downwardly revised. Multifamily starts rose 4.9% to 427,000 units after rising to 378,000 units in October. The single-family market has been improving all year, with starts just 0.4% below the level for November 2018, and on track to end the year about on par with 2018. New-Home Sales Rise 1.3% New-home sales rose 1.3% in November to a seasonally adjusted annual rate of 719,000 units from a downwardly revised reading in October. It was the fourth consecutive month new home sales have exceeded 700,000 units. New home sales have been running 10% higher than in 2018. The inventory of new homes for sale rose slightly to 323,000 in November, a 5.4-months’ supply at the current sales pace, up slightly from October. Of that number, 76,000 homes are completed and ready to occupy; the remainder are in various stages of completion. The median sales price rose to $330,800 in November after falling to $316,200 in October and was up from $308,500 in November 2018. Regional new home sales year to date were mixed. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously-owned homes, which are calculated when a contract closes. Existing Home Sales Fall 1.7% Existing home sales fell 1.7% in November to a seasonally adjusted annual rate of 5.35 million homes after rising to 5.46 million in October. Existing home sales were up 2.7% from November 2019. The median existing-home price was up 5.4% from November 2018. November’s price increase marks 93 consecutive months of year-over-year gains. Total housing inventory at the end of November fell 7.3% to 1.64 million units and was down 5.7% from November 2018. Unsold inventory was at a 3.7-month supply at the current sales pace, down from 3.9 months in October and from 4.0-months in November 2018. Unsold inventory totals have declined for five consecutive months. Low levels of inventory depress sales. Regional existing homes sales were mixed. Regional Housing Data Mortgage Rates Rise to 3.74%

© Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.to edit.

|

|