|

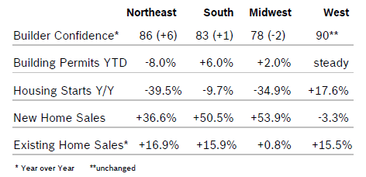

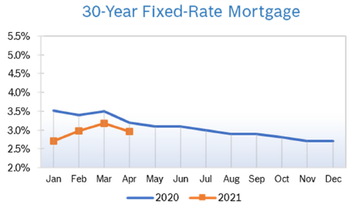

Builder Confidence Rises to 83 Builder confidence rose one point to 83 in April after falling to 82 in March, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). It was the eighth consecutive month the index was above 80. While buyer demand is strong, rising costs and lengthening delivery times for materials, particularly softwood lumber, are impacting sentiment. The HMI index gauging current sales conditions rose one point to 88, while the component measuring sales expectations in the next six months fell two points to 81. The gauge charting traffic of prospective buyers rose three points to 75. Regional scores were mixed for the fifth consecutive month. Any number over 50 indicates that more builders view the component as good than view it as poor. Building Permits Rise 2.7% Overall permits increased 2.7% to a 1.77 million unit annualized rate in March after falling to 1.68 million units in February. Single-family permits increased 4.6% to 1.20 million units after falling to 1.14 million units in February. Multifamily permits dropped 1.2% to a 567,000 pace after falling to 539,000 units in February. On a year-to-date regional basis, permits were mixed. Housing Starts Rise 19.4% Housing starts rose 19.4% in March to a seasonally adjusted annual rate of 1.74 million units after falling to 1.42 million units in February. Single-family starts rose 15.3% to a seasonally adjusted annual rate of 1.24 million units after dropping to 1.04 million units in February. The multifamily sector, which includes apartment buildings and condos, jumped 30.8% to 501,000 units after falling to 381,000 units in February. Combined single-family and multifamily regional starts were mixed year to date compared to 2020. Single-family starts are expected to rise this year, but at a much slower pace than they did during 2020. New Home Sales Rise 20.7% New home sales rose 20.7% in March to a seasonally adjusted annual rate of 1.02 million homes and sales for February were revised upwards after initially showing a decline of 18.2%. It was the highest pace of sales since September 2006. Inventory fell to a 3.6 months' supply, with 307,000 new single-family homes for sale, 44.6% lower than March 2020. Homes sold but not yet under construction are up 150% over last year, an indicator of increasing delays and higher costs associated with construction. Demand is strong, with builders reporting they could sell more homes if they had more inventory. The median sales price was $330,800, up from the $328,200 median sales price posted a year earlier and down from $349,400 in February. Regional new home sales were mixed. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously-owned homes, which are calculated when a contract closes. Existing-Home Sales Fall 3.7% Existing-home sales fell 3.7% in March to a seasonally adjusted annual rate of 6.01 million homes after falling to 6.22 million homes in February, according to the National Association of Realtors (NAR). Sales were up 12.3% from March 2020 when the pandemic began impacting sales. The inventory of homes available for sale at the end of March rose 3.9% from February to 1.07 million homes. Even with the increase, inventories remain at historic lows and are 28.2% lower than they were a year ago. The current inventory translates into just a 2.1-month supply at the current sales pace, up slightly from a 2-month supply in February but down from a 3.3-month supply in March 2020. Sales fell in all four regions of the country but were still up year over year. According to Wells Fargo, sales would have likely been higher if there were more homes on the market. Higher home prices are also pushing some buyers out of the market as now their housing budget buys less home. The median price of an existing home has risen 17.2% over the past year to $329,100. Regional Housing Data Remodeling Index Rises to 86 The National Association of Home Builders (NAHB) Remodeling Market Index (RMI) rose to 86 in the first quarter, up 38 points first quarter 2020. The strong reading shows that residential remodelers are very confident in their markets for projects of all sizes. In the first quarter, all components and subcomponents of the RMI were up substantially. The Current Conditions Index was up 31 points from Q1 2020 at 89, with large remodeling projects ($50,000 or more) at 85, moderately-sized remodeling projects ($20,000 to $50,000) at 90 and small remodeling projects (under $20,000) at 92. The Future Indicator Index averaged 84, up 45 points from the first quarter of 2020, with the rate at which leads and inquiries are coming in at 86 and the backlog of remodeling jobs at 82. NAHB expects remodeling activity to continuing growing but notes that material availability and prices will remain a challenge. Mortgage Rates Remain Below 3.0

© Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|