|

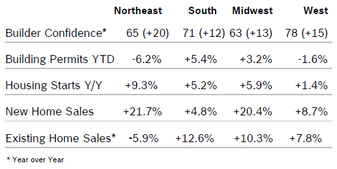

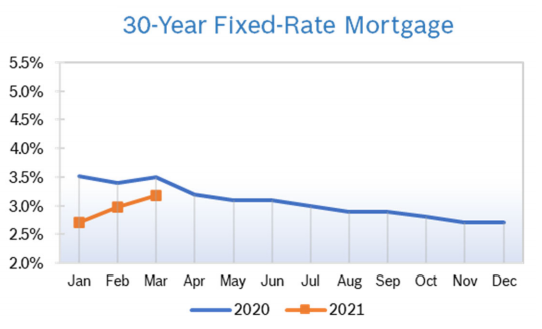

Builder Confidence Falls to 75 Builder confidence dropped one point to 75 in January after rising five points to 76 in December, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). The HMI index charting traffic of prospective buyers increased one point to 58, the highest level since December 2017. The gauge measuring current sales conditions fell three points to 81 and the component measuring sales expectations in the next six months held steady at 79. The strong labor market, low mortgage rates and a shortage of existing homes are all fueling the housing rebound. The three-month moving average for builder confidence rose in all regions except the South, where it was unchanged. Building Permits Fall 3.9% Building permits fell 3.9% in December to a seasonally adjusted annual rate of 1.42 million after rising to 1.48 million units in November. Single-family permits fell 0.5% to 916,000 annual units after rising to 918,000 units in November. Multifamily permits fell 9.6% to 500,000 annual units. Permits rose in all regions on a year-to-date basis. Housing Starts Rise 16.9% Housing starts rose 16.9% in December to a seasonally adjusted annual rate of 1.61 million units after rising to 1.37 million units in November. It was the highest level of starts in 13 years. Single-family starts increased 11.2% to 1.06 annual units after rising to 938,000 units in November. Multifamily starts rose 29.8% to 553,000 units after rising to 427,000 units in November. Total housing starts for 2019 were 1.29 million, a 3.2% gain over the 1.25 million starts in 2018. Single-family starts rose 1.4% in 2019 to 888,200 annual units. Multifamily starts in 2019 rose 7.3% to 401,600 units. Regional housing starts were mixed. New-Home Sales Fall 0.4% New-home sales fell 0.4% in December to a seasonally adjusted annual level of 694,000 new homes after rising to a downwardly revised 697,000 units in November. It was the first time in five months new home sales have fallen below 700,000 units. For the full year of 2019, new home sales rose 10.3% to a total of 681,000 units. The inventory of new homes for sale is a 5.7-months’ supply at the current sales pace, up from 5.4 months in November. Supplies are now at a level NAHB describes as “comfortable.” Approximately 78,000 homes are completed and ready to occupy; the remainder are in various stages of completion. The median sales price rose to $331,400 in December after rising to $330,800 in November. Regional new home sales year to date were mixed. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously-owned homes, which are calculated when a contract closes. Existing Home Sales Rise 3.6% Existing home sales rose 3.6% in December to a seasonally adjusted annual rate of 5.4 million homes after falling to 5.35 million in November. Existing home sales were up 10.8% from December 2019. The median home price rose 7.8% from December 2019 to $272,500, marking 94 consecutive months of year-over-year gains. Total housing inventory at the end of November fell 14.6% to 1.40 million units and was down 8.5% from December 2018. Unsold inventory was at just a 3.0-months’ supply at the current sales pace, down from a 3.7-months’ supply in both November and in December 2018. Unsold inventory totals have declined for six consecutive months. Regional existing homes sales were mixed. Remodeling Index Rises to 58 NAHB’s remodeling index (RMI) rose three points to 58 in the fourth quarter. The RMI has been consistently above 50, the level that indicates that more remodelers report market activity is higher compared to the prior quarter than report it is lower, since the second quarter of 2013. NAHB says the low inventory of homes is forcing many people to stay put and remodel their existing home instead of trying to move. The current market conditions indicators increased two points from the previous quarter to 56. Among its three major components, major additions and alterations gained four points to 56, minor additions and alterations increased by one point to 54 and the home maintenance and repair component rose one point to 58. The future market indicators gained three points from the previous quarter to 60. Among its components, calls for bids increased by three to 58, amount of work committed for the next three months gained three points to 57, the backlog of remodeling jobs jumped five points to 64 and appointments for proposals increased by two points to 62. The jump in backlogs is an indicator that demand is high and labor is in short supply. NAHB predicts that remodeling spending for owner-occupied single-family homes will decrease 0.6% in 2020 and increase 1.2% in 2020. Housing Forecast NAHB projects that total housing starts will rise more than 2% to 1.3 million units in 2020, the highest output since 2007 but well below normal production levels of 1.5 million units annually from 1960-2007. Single-family starts are expected to rise more than 3% to about 920,000 units, still significantly below the 1 million to 1.1 million units that demographics would support. NAHB expects multifamily starts to hold relatively steady this year at 383,000 units. Currently, 93% of all multifamily units are built for rent; only 7% are constructed for sale. The historical split is 80-20. New-home sales are projected to rise 2.5% to a total 708,000 in 2020. If that happens, it would mark the first year sales surpassed 700,000 since 2007. Residential remodeling activity is expected to register a 1% gain this year over 2019, as existing home sales improve. Regional Housing Data Mortgage Rates Fall to 3.51%

© Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|