|

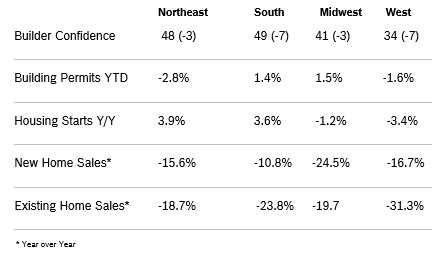

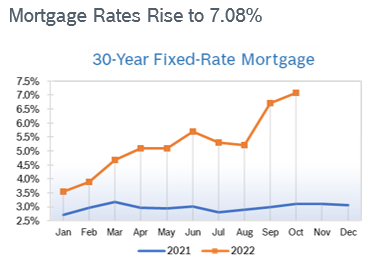

Builder Confidence Falls to 38 Builder confidence fell eight points in October to 38 after dropping to 46 in September, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). It was the tenth consecutive monthly decline for the HMI after it hit an all-time high of 90 last November. The decline left the HMI below 50 for the third consecutive month and was the lowest confidence reading since 2012 with the exception of the onset of the pandemic in 2020. Rising inflation, higher mortgage rates and production bottlenecks are leading to slowing traffic and falling confidence. All three HMI components posted declines in October. Current sales conditions fell nine points to 45, sales expectations in the next six months declined 11 points to 35 and traffic of prospective buyers fell six points to 25. Scores fell in all regions. Any number over 50 indicates that more builders view the component as good than view it as poor. Building Permits Rise 1.4% Overall building permits rose 1.4% in September to a 1.56 million unit annualized pace after falling to 1.52 million units in August. Single-family permits fell 3.1% in September to 872,000 units after falling to 899,000 units in August. It was the lowest reading for single-family permits since June 2020 and marked the seventh consecutive month single-family permits have declined. Multifamily permits rose 7.8% to an annualized pace of 692,000 units. Regional permits were mixed year to date. Housing Starts Fall 8.1% Housing starts fell 8.1% in September to a seasonally adjusted annual rate of 1.44 million units after rising to 1.58 million units in August. Single-family starts fell 4.7% to 892,000 units after rising to 935,000 units in August and were down 5.6% year to date. Multifamily starts dropped 13.2% to 547,000 units after jumping to 640,000 units in August. Regional starts were mixed. NAHB (National Association of Home Builders) says higher construction costs and interest rates are causing builder traffic to decline. New Home Sales Fall 10.9% New home sales fell 10.9% in September to a seasonally adjusted annual rate of 603,000 new homes after rising to 685,000 homes in August. Sales were down 17.6% from September 2021 and 14.3% year to date. Sales are also down 1.9% from pre-pandemic days in 2019. Inventory increased to 468,000 new homes, a 9.2-months’ supply at the current sales pace, up from 8.1 months in August. However, only 56,000 homes are ready to occupy. The median new home price was up 8% from September 2021 to $470,600. The slowing in price increases reflects the growing number of builders who are cutting prices due to falling demand. New home sales fell year over year in all regions. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously-owned homes, which are calculated when a contract closes. Existing Home Sales Fall 1.5% Existing home sales fell 1.5% in September to a seasonally adjusted annual rate of 4.71 million units after falling to 4.80 million units in August, according to the National Association of Realtors. It was the eighth consecutive month existing home sales fell. Sales were down 23.8% from September 2021. The inventory of unsold existing homes declined in September for the second straight month to 1.25 million, a 3.2 months' supply at the current monthly sales pace. The median existing-home sales price increased to $384,800 in September, up 8.4% from one year ago. Median prices have now increased year over year for 127 consecutive months, the longest-running streak on record. Properties typically remained on the market for 19 days in September, up from 16 days in August and 17 days in September 2021. Seventy percent of homes sold in September 2022 were on the market for less than a month. Regional sales were mixed. Regional Housing Data

© Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|