|

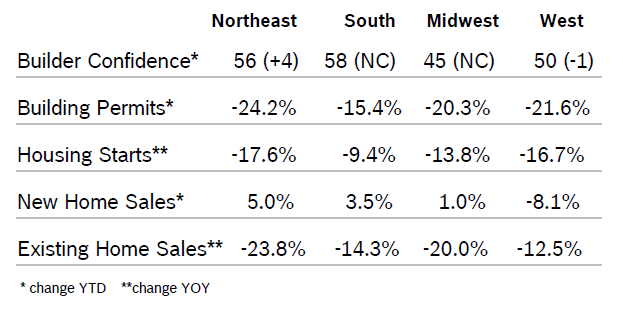

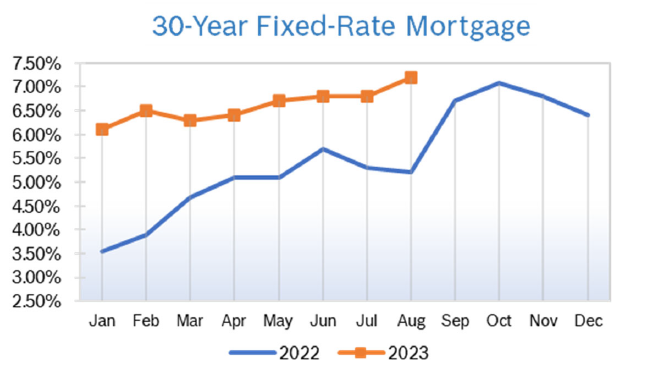

Builder Confidence Falls to 50 Builder Confidence fell six points to 50 in August after rising one point to 56 in July, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). The decrease came after seven consecutive monthly increases in confidence. Much of the decrease came from a big decline in buyer traffic, which fell to 34 from a year-long high of 40. Sales expectations for the next six months fell to 55 from 59 in July. The HMI index gauging current sales conditions fell five points to 57 in August. Regional scores were mixed. The August HMI survey also revealed that 55% of builders are using sales incentives, up from July but still down from 62% at the end of 2022. Any number over 50 indicates that more builders view the component as good than view it as poor. Building Permits Rise 0.1% Overall building permits inched up 0.1% in July to 1.44 million annual units after falling to a slightly downwardly revised number in June. Single-family permits rose 0.6% to 930,000 annual units after rising to 922,000 units in June and were up 1.3% from July 2022. Multifamily permits dropped 1.0% to an annualized pace of 512,000 units after rising to 518,000 units in June. Permits fell year to date in all regions. Housing Starts Rise 3.9% Housing starts rose 3.9% in July to a seasonally adjusted annual rate of 1.45 million units after falling to 1.43 million units in June. Single-family starts rose 6.7% to a seasonally adjusted annual rate of 983,000 homes after falling to 935,000 homes in June. The number of single-family units under construction is down 16.9% from July 2022 to 678,000 units. Starts fell year over year in all regions. New Home Sales Rise 4.4% New home sales rose 4.4% in July to a seasonally adjusted annual rate of 714,000 homes from a downwardly revised reading in June, according to the National Association of Home Builders (NAHB). Sales were up 31.5% from July 2022. New home sales are benefitting from a lack of inventory of existing homes as homeowners stay put rather than buy a more expensive new home that will come with a higher mortgage rate. New single-family home inventory rose 4.8% to 437,000, a 7.3 months’ supply at the current pace; a 6 months’ supply is considered balanced. New homes now account for about 31% of the total number of homes available or sale. The median price of a new home in July fell 9% year over year to $436,700. Pricing is down due to builder incentives as well as a shift towards building slightly smaller homes. Regional sales year to date were mixed. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously-owned homes, which are calculated when a contract closes. Existing Home Sales Fall 2.2% Existing home sales fell 2.2% in July to a seasonally adjusted annual rate of 4.07 million new homes after falling to 4.16 million new homes in June, according to the National Association of Realtors. Sales were down 16.6% from July 2022. The median existing-home sales price rose 1.9% to $406,700 in July from July 2022, the fourth time the median existing home price has exceeded $400,000. Inventory rose 3.7% to 1.11 million homes after holding at 1.08 million homes in June, a 3.3 months’ supply at the current sales pace. The current supply of existing homes for sale is roughly half what it was in 2019 before the pandemic. Regional sales were mixed year to date. Regional Housing Data Mortgage Rates Rise to 7.2%

© Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|