|

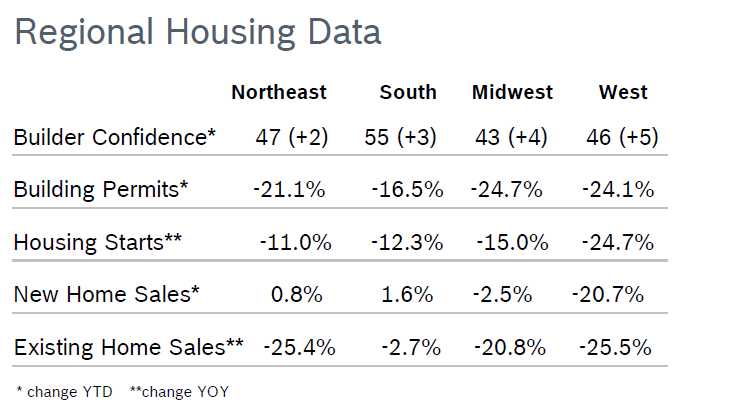

Builder Confidence Rises to 55 Builder Confidence rose five points to 55 in June after rising to 50 in May, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). It was the sixth consecutive monthly increase in confidence and the first time confidence has exceeded the midpoint of 50 since July 2022. All three major HMI indices posted gains in June. The HMI index gauging current sales conditions rose five points to 61, sales expectations in the next six months increased six points to 62 and traffic of prospective buyers increased four points to 37. About half of all builders continue to offer incentives and 25% offer an average price reduction of 7% to stimulate sales and help offset rising mortgage rates. Any number over 50 indicates that more builders view the component as good than view it as poor. Building Permits Rise 5.2% Overall building permits rose 5.2% in May to 1.49 million annual units after falling to 1.42 million units in April. Single-family permits rose 4.8% in May to 897,000 million annual units after rising to 855,000 units in April but were down 25.5% from April 2022. Multifamily permits rose 5.9% to an annualized pace of 594,000 units after falling to 561,000 units in April. Permits rose year to date in all regions. Housing Starts Rise 21.7% Housing starts rose 21.7% in May to a seasonally adjusted annual rate of 1.63 million units after inching up to 1.40 million units in April. Single-family starts jumped 18.5% to a seasonally adjusted annual rate of 997,000 units after rising slightly to 846,000 units in April. Despite hitting an 11-month high, starts were down 28.1% from April 2022. Multifamily starts rose 3.2% to 555,000 annual units after March numbers were downwardly revised. Regional starts were mixed. New Home Sales Rise 12.2% New home sales jumped 12.2% in May to a seasonally adjusted annual rate of 763,000 homes after rising to 683,000 homes in April, according to the National Association of Home Builders (NAHB). Sales were much higher than expected and up 20.0% from May 2022 and were at the highest level since February 2022. New single-family home inventory dropped to a 6.7 months’ supply from 7.6 months in April; about six months is considered a normal, balanced market. The median new home price was $416,300, down 7.6% on a year-over-year basis in May, but up 3.5% from April. Regional sales were down year to date in all regions. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously-owned homes, which are calculated when a contract closes. Existing Home Sales Rise 0.2% Existing home sales inched up 0.2% in May to a seasonally adjusted annual rate of 4.30 million homes after falling to 4.28 million in April, according to the National Association of Realtors. Sales were down 20.4% from May 2022. The median existing-home sales price of $396,100 was up from April but down 3.1% from May 2022. The inventory of unsold existing homes increased 3.8% in May to 1.08 million homes, a 3.0 months’ supply at the current sales pace, up slightly from April. The current supply of existing homes for sale is roughly half what it was in 2019 before the pandemic. Regional sales were mixed year to date. Regional Housing Data Mortgage Rates Rise to 6.7%

© Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|