|

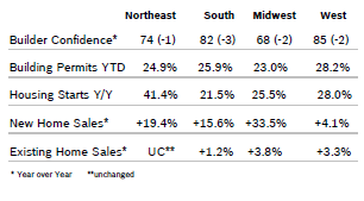

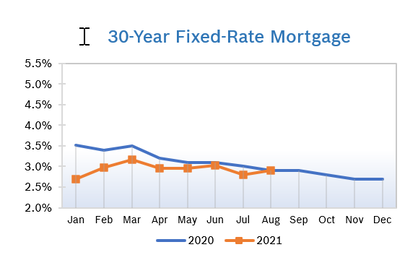

Builder Confidence Falls to 75 Builder confidence fell five points to 75 in August after slipping to 80 in July, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). The index had been above 80 for ten consecutive months. Builders are grappling with supply shortages, rising prices and long waits for materials. In addition, rising prices for materials are inflating the price of a new home, creating sticker shock and sending many buyers to the sidelines. The HMI index gauging current sales conditions fell five points to 81 and the component measuring traffic of prospective buyers fell five-points to 60. The gauge charting sales expectations in the next six months held steady at 81. Regional scores declined in all regions for the first time in eight months. Any number over 50 indicates that more builders view the component as good than view it as poor. Building Permits Fall 5.1% Overall building permits fell 5.1% in July to a 1.53-million-unit annualized pace after dropping to 1.60 million units in June. Single-family permits dropped 4.5% in July. Multifamily permits plunged 13.1% to an annual rate of 413,000 units after dropping in June. NAHB notes that permits have been falling because builders are slowing construction due to higher costs for materials and continuing shortages of labor and supplies. Regional permits were up on a year-to-date basis. Housing Starts Fall 7.0% Housing starts fell 7.0% in July to a seasonally adjusted annual rate of 1.53 million homes after rising to 1.64 million units in June. Single-family starts fell 4.5% to a seasonally adjusted annual rate of 1.11 million units after rising to 1.16 million units in June. The multifamily sector, which includes apartment buildings and condos, dropped 13.1% to 423,000 units after rising to 483,000 units in June. Combined single-family and multifamily regional starts were up year to date compared to 2020. The drop in starts reflects the drop in builder confidence as builders grapple with shortages of materials and labor and production bottlenecks. Single-family starts are still expected to rise this year, but at a much slower pace than they did during 2020. New Home Sales Rise 1.0% New home sales rose 1.0% in July to a seasonally adjusted annual rate of 708,000 homes after June sales were upwardly revised. Inventory continued to remain at a more normalized level of 6.2 months after spending many months at historic lows. Nevertheless, inventory is 26.1% lower than it was in July 2020. While inventory is rising, as of July 2021, 29% of new home inventory consisted of homes not yet under construction, compared to 20% a year ago. The median sales price was $390,500, up 18.4% from a year earlier, due to higher development costs, including materials. Year-over-year sales were up in all regions. NAHB cautioned that the big jump in year-over-year sales is due to the big slowdown in sales during the initial stages of the pandemic. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously owned homes, which are calculated when a contract closes. Existing Home Sales Rise 2.0% Existing home sales rose 2.0% in July to a seasonally adjusted annual rate of 5.99 million units after rising to an upwardly revised 5.87 million units in June, according to the National Association of Realtors. The median price of a home sold in July fell slightly to $359,900 from $362,800 in June. Prices are still up 17.8% on a year-over-year basis, which marks some improvement from earlier this year when prices were up a record 23.6%. Total inventories have risen for five consecutive months, but much of the activity is occurring in the upper end of the market. There is a still a shortage of starter homes, and inventory remains at a low 2.6-month supply. It was the 113th monthly increase in year-over-year prices. Regional sales were mixed. Regional Housing Data Mortgage Rates Remain Low

© Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|