|

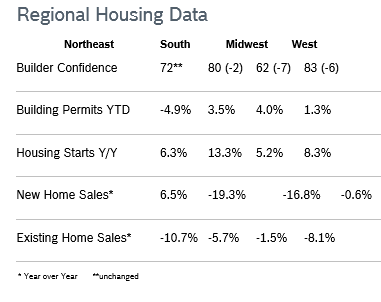

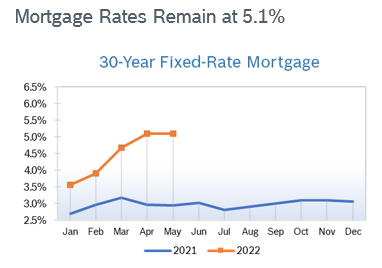

Builder Confidence Falls to 69 Builder confidence fell eight points to 69 in April after falling to a downwardly revised 77 in March, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). It was the fifth consecutive month the HMI declined after hitting an all-time high of 90 last November. According to NAHB, building material costs are up 19% from a year ago, in less than three months mortgage rates have surged to a 12-year high and based on current affordability conditions, less than 50% of new and existing homes are affordable for a typical family. All three major indices that make up the HMI fell significantly in April. The HMI index gauging current sales conditions fell eight points to 78, sales expectations in the next six months dropped 10 points to 63 and the component charting traffic of prospective buyers fell nine points to 52. Regional scores remained mixed. Any number over 50 indicates that more builders view the component as good than view it as poor. Building Permits Fall 3.2% Overall permits fell 3.2% in April to 1.82 million units after rising to 1.87 million units in March. Single-family permits fell 4.6% to 1.11 million units after being essentially flat in March. Multifamily permits fell 1.0% to 709,000 annual units after rising sharply to 726,000 units in March. Single-family permits authorized but not started are up 8.5% year-over-year to 153,000 units. Regional permits were mixed year to date. Housing Starts Fall 0.2% Housing starts fell 0.2% in April to a seasonally adjusted annual rate of 1.72 million units after rising to a downwardly revised reading in March. Single-family starts plunged 7.3% to 1.10 million units after falling to 1.20 million units in March but are still up 4.1% year over year. Multifamily starts rose 15.3% to 624,000 units after rising to 593,000 units in March. Starts were up in all regions. Single-family units under construction are up 26% year-over-year to 815,000 units. NAHB says supply chain disruptions need to be resolved so builders can increase production and contain costs. Rising costs and climbing mortgage rates continue to make housing less affordable and pricing more first-time buyers out of the market. New Home Sales Fall 16.6% New home sales dropped 16.6% in April to a seasonally adjusted annual rate of 591,000 homes after falling to 763,000 homes in March. Sales were down 26.9% from April 2021. The median new home price jumped 19% year over year to $450,600 after rising to $436,700 in March. Strong price growth is expected to persist into 2023. A year ago, 25% of new homes sold were below $300,000; in April that fell to just 10%. New single-family home inventory jumped to a 9 months’ supply, up 40% over last year, with 444,000 available for sale. However, just 38,000 of those homes are completed and ready to occupy. Regional sales were mixed. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously-owned homes, which are calculated when a contract closes. Existing Home Sales Fall 2.4% Existing home sales fell 2.4% in April to a seasonally adjusted annual rate of 5.61 million units after falling to 5.77 million units in March, according to the National Association of Realtors. It was the third consecutive month existing home sales fell. Sales were down 5.9% from April 2021. The inventory of unsold existing homes increased to 1.03 million after rising to 900,000 homes in March. Inventory was still down more than 10% from April 2021. There was a 2.2 months’ supply of homes at the current sales pace, up from 2.0 months in March. The median existing-home sales price was up 14.8% year over year to $391,200. Year-over-year prices have risen for 121 consecutive months. Properties were on the market for an average of just 17 days in April, with homes priced under $500,000 being snapped up in even less time. All-cash sales are still accounting for more than 25% of sales. Existing home sales fell in all regions.

© Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|