|

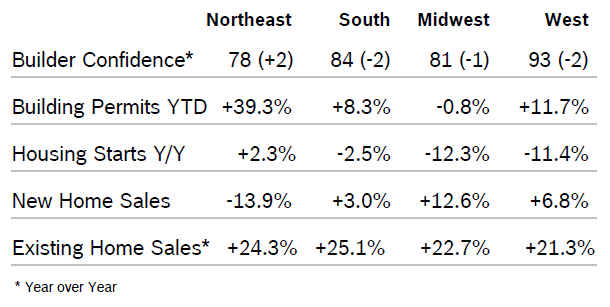

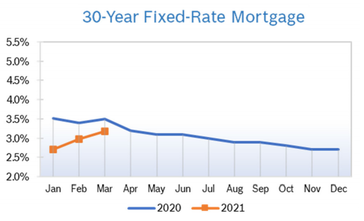

Builder Confidence Rises to 37 Builder confidence rose seven points to 37 in May after dropping 42 points to 30 in April, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). Lower interest rates and builders adapting to the new realities of finding digital ways to connect with potential buyers, including using social media and providing virtual tools such as home tours and online meetings and closings, contributed to the increased optimism. All the HMI indices posted gains in May. The HMI index gauging current sales conditions increased six points to 42, the component measuring sales expectations in the next six months jumped 10 points to 46 and the measure charting traffic of prospective buyers rose eight points to 21. Regional scores rose in every region but the Northeast, where many states remained fully shut down for the month. Building Permits Fall 20.8% Building permits fell 20.8% in April to a seasonally adjusted annual rate of 1.07 million units after falling to 1.35 million units in March. Single-family permits fell 24.3% to 669,000 units in April after falling to 884,000 units in March. Multifamily permits fell 14.2% to 405,000 units after rising to 469,000 units in March. Year-to-date regional permits were mixed. Housing Starts Fall 30.2% Housing starts fell 30.2% in April to a seasonally adjusted annual rate of 891,000 units after falling to 1.22 million units in March. Single-family starts fell 25.4% to 650,000 annual units after falling to 856,000 annual units in March. Multifamily starts fell 40.5% to 241,000 units after falling to 360,000 units in March. Regional starts were mixed. The declines, although large, were actually less than expected. NAHB says there is an underlying long-term positivity in the housing industry that will support a rebound and housing is poised to lead the economy into recovery. New-Home Sales Rise 0.6% New-home sales rose 0.6% in April to a seasonally adjusted annual pace of 623,000 from a downwardly revised March reading. Sales were well above expectations, but 6.2% below April 2019. The biggest declines in sales were in the hard-hit Northeast and West. Inventory fell to a 6.3 months’ supply, with 325,000 new single-family homes for sale, 3.0% lower than April 2019. The number of homes completed and ready to occupy rose by 2,000 to 78,000. The median sales price fell to $303,900 from $321,400 in March, due builders using incentives in April. The median sales price was also down from $339,000 in April 2019. Regional new home sales were mixed. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously-owned homes, which are calculated when a contract closes. Existing Home Sales Fall 17.8% Existing home sales fell 17.8% in April to a seasonally adjusted annual rate of 4.33 million after dropping to 5.27 million in March. It was the lowest monthly rate of sales since July 2010. Existing home sales were down 17.2% from April 2019. The median home price was $286,800, up 7.4% from April 2019, marking 98 consecutive months of year-over-year gains. Total housing inventory at the end of April totaled 1.47 million units, down 1.3% from March and down 19.7% from one year ago. Unsold inventory sits at a 4.1-month supply at the current sales pace, up from 3.4-months in March and down from 4.2 months in April 2019. Regional existing homes sales year over year fell in all regions. The pandemic hit the housing market at what is usually the height of the spring buying season, and the National Association of Realtors (NAR) says a full rebound is unlikely due to widespread uncertainty. They expect a slow and gradual recovery, aided by continuing low mortgage rates. Regional Housing Data Mortgage Rates Fall to 3.15%

© Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|