|

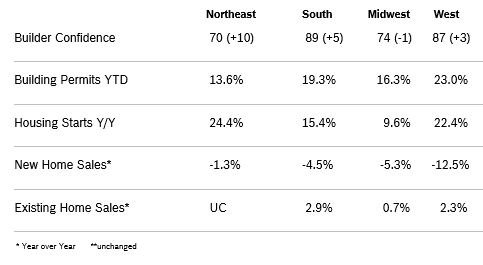

Builder Confidence Rises to 84 Builder confidence rose one point to 84 in December after rising to 83 in November, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). The HMI hit an all-time high of 90 last November. Low existing inventories and strong buyer demand continued to keep confidence high despite persistent supply chain issues and chronic shortages of materials, land and labor. All three major HMI indices posted gains in October. The HMI index gauging current buyer traffic edged up one point to 70. The present sales index rose one point to 90 and the index measuring expectations for future sales remained at 84 for the third consecutive month. All three components remain exceptionally high. Regional scores remained mixed. Any number over 50 indicates that more builders view the component as good than view it as poor. Building Permits Rise 3.6% Overall building permits rose 3.6% in November to an annualized pace of 1.71 million units after rising to 1.65 million units in October. Single-family permits rose 2.7% to an annualized pace of 1.10 million units after rising to 1.07 million units in October. Multifamily permits rose 5.2% to 609,000 units after rising to 581,000 units in October. Due to supply chain issues, there are 152,000 single-family units that have been permitted but have not yet begun construction, up 43.4% from a year ago. Regional permits were up on a year-to-date basis. Housing Starts Rise 11.8% Housing starts rose 11.8% in November to a seasonally adjusted annual rate of 1.68 million units after falling to 1.52 million units in October. Single-family starts rose 11.3% to 1.17 million units after falling to 1.04 million units in October. Single-family starts were up 28% year-to-date. The multifamily sector, which includes apartment buildings and condos, rose 12.9% to 506,000 units after rising to 481,000 units in October. Combined single-family and multifamily regional starts were up year to date compared to 2020. Starts undoubtedly benefitted from mild weather throughout much of the country and a relatively late Thanksgiving. New Home Sales Jump 12.4% New home sales jumped 12.4% in November to a seasonally adjusted annual rate of 744,000 new homes after sales for October were downwardly revised. Sales were down 14% from November 2020. Inventory remained steady at a 6.5-months' supply, with 402,000 new single-family homes for sale, up substantially from 290,000 homes in November 2020.The median sales price rose to $416,900 from the $408,700 median sales price posted in October and was up 18.8% year over year, due to higher development costs, including materials. Sales of new homes fell in all regions. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously-owned homes, which are calculated when a contract closes. Existing Home Sales Rise 1.9% Existing home sales rose 1.9% in November to a seasonally adjusted annual rate of 6.46 million units after rising to 6.34 million units in October. Sales were down 5.8% from October 2020, according to the National Association of Realtors. The median price in November rose to $353,900, up 13.9% year-over-year. Year-over-year prices have risen for 117 consecutive months. Total inventories fell nearly 10% to just 1.1 million homes, a scant 2.1 months’ supply at the current sales pace, the lowest since March and close to the record low of 1.9 months set in 2020. Properties were on the market for an average of just 18 days in November. Regional sales were mixed. Regional Housing Data

© Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval

Comments are closed.

|

|