|

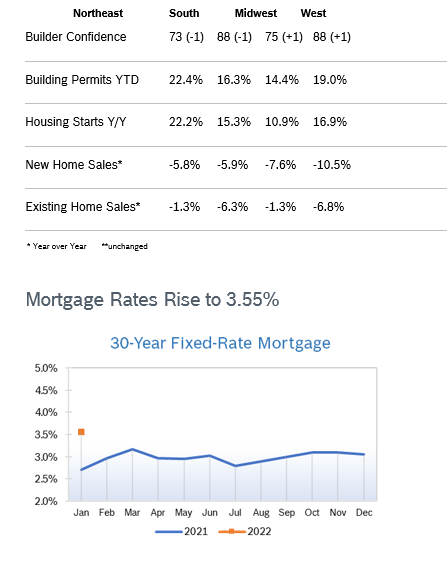

Builder Confidence Falls to 83 Builder confidence fell back one point to 83 in January after rising to 84 in December, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). The HMI hit an all-time high of 90 last November. Low existing inventories and strong buyer demand have kept confidence in a narrow range for months despite persistent supply chain issues and chronic shortages of materials, land and labor. NAHB analysis indicates the aggregate cost of residential construction materials has increased almost 19% since December 2020. The HMI index gauging current sales conditions held steady at 90, the gauge measuring sales expectations in the next six months fell two points to 83, and the component charting traffic of prospective buyers fell two points to 69. Regional scores remained mixed. Any number over 50 indicates that more builders view the component as good than view it as poor. Building Permits Rise 9.1% Overall permits increased 9.1% to a 1.87 million unit annualized rate in December after rising to 1.71 million units in November. Single-family permits increased 2.0% to a 1.13 million unit rate after rising to 1.10 million units in November. Multifamily permits increased 21.9% to a 745,000 pace. Single-family homes permitted but not authorized are now down to 144,000 compared to 154,000 in October but are still up 38.5% compared to a year ago. Regional permits were up year to date. Housing Starts Rise 1.4% Housing starts rose 1.4% in December to a seasonally adjusted annual rate of 1.70 million units after rising to 1.68 million units in November. Single-family starts fell 2.3% to 1.17 million units after jumping to a downwardly revised number in November. Total housing starts rose 15.6% in 2021 to 1.60 million. Single-family starts for the year rose 13.4% to 1.12 million. Multifamily starts rose 22.1% in 2021 were up 22.1%. Combined single-family and multifamily regional starts were up year to date compared to 2020. New Home Sales Rise 11.9% New home sales rose 11.9% in December to a seasonally adjusted annual rate of 811,00 in December. However, sales for both October and November were revised downward. Sales were down 7.3% from December 2020. Inventory remained steady at a 6-months’ supply, with 403,000 new single-family homes for sale, up 34.8% from December 2020. The median sales price fell to $377,700 from $416,100 in November and was up just 3.4% from December 2020. Analysts note that the jump in new home sales may reflect people trying to get homes under contract before mortgage rates increase further. In addition, the slight easing of supply chain issues in the fall allowed more homes to be completed; supply chain issues worsened again later in the year when the devastating floods in Canada caused lumber prices to skyrocket again. Sales of new homes fell in all regions. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously-owned homes, which are calculated when a contract closes. Existing Home Sales Fall 4.6% Existing home sales fell 4.6% in December to a seasonally adjusted annual rate of 6.18 million units after rising to 6.46 million units in November. Sales were down 7.1% from December 2020, according to the National Association of Realtors. The median price rose to $358,000 in December from $353,900 in November and was up 15.8% year-over-year. Year-over-year prices have risen for 118 consecutive months. Total inventories fell 18% in December to an all-time low of just a 1.8-month supply at the present sales pace, down from 2.1 months in November and from 1.9 months in December 2020. Properties were on the market for an average of just 19 days in December. Existing home sales fell in all regions. Remodeling Index Rises to 83 The NAHB/Royal Building Products Remodeling Market Index (RMI) rose four points to 83 in the fourth quarter of 2021. Higher home equity has given homeowners the confidence to invest in their homes and fueled a boom in remodeling. However, many remodelers are booked for months, and supply chain issues continue to create problems and make it tough for remodelers to work off their backlogs. The Current Conditions Index, which is an average of scores for small, medium and large-sized remodeling projects, rose to 89 compared to Q4 2020. All components of the Current Conditions Index also posted increases compared to the fourth quarter of last year: large remodeling projects ($50,000 or more) climbed seven points to 85, moderately-sized remodeling projects (at least $20,000 but less than $50,000) rose two points to 90 and small remodeling projects (under $20,000) increased two points to 91. The Future Indicators Index averaged 77, up five points from the fourth quarter of 2020. Both components increased as well: the current rate at which leads and inquiries are coming in rose three points to 74 and the backlog of remodeling jobs climbed seven points to 80. Data for the RMI was collected in December so did not reflect the impact of rising mortgage rates. Regional Housing Data

© Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval

Comments are closed.

|

|