|

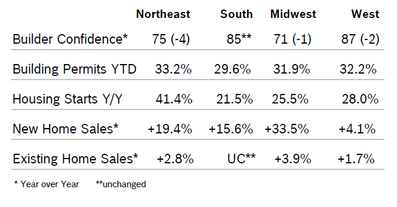

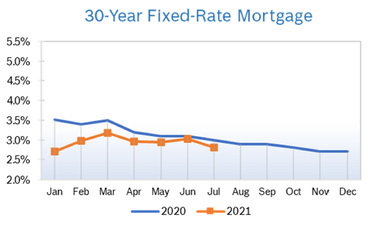

Builder Confidence Falls to 80 Builder confidence fell one point to 80 in July after slipping two points in June, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). The index had been above 80 for ten consecutive months. Builders are grappling with supply shortages, rising prices and long waits for materials. In addition, rising prices for materials are inflating the price of a new home, which is resulting in appraisals that are too low for consumers to qualify for the mortgage needed. That’s also making it harder for builders to access construction loans. The three major HMI indices were mixed in June. The HMI index gauging current sales conditions fell one point to 86, the component measuring traffic of prospective buyers dropped six points to 65 and the gauge charting sales expectations in the next six months posted a two-point gain to 81. Regional scores were mixed for the seventh consecutive month. Any number over 50 indicates that more builders view the component as good than view it as poor. Building Permits Fall 5.1% Overall permits fell 5.1% in June to a 1.60 million unit annualized pace in June after falling to a 1.68 million units in May. Single-family permits dropped 6.3% in June to 1.06 million units after falling to 1.13 million units in May. Multifamily permits dropped 2.6% to an annual rate of 535,000 units after falling to 551,000 units in May. NAHB notes that permits have been falling because higher costs for materials have been pushing new home prices higher since the end of last year. Regional permits were up on a year-to-date basis. Housing Starts Rise 6.3% Housing starts rose 6.3% in June to a seasonally adjusted annual rate of 1.64 million units after rising to 1.57 million units in May. Single-family starts rose 6.3% in June to a seasonally adjusted annual rate of 1.16 million units after rising to 1.10 million units in May. The multifamily sector, which includes apartment buildings and condos, rose 6.2% in June to 483,000 units after rising to 474,000 units in May. Combined single-family and multifamily regional starts were up year to date compared to 2020. Single-family starts are still expected to rise this year, but at a much slower pace than they did during 2020. New Home Sales Fall 6.6% New home sales fell 6.6% in May to a seasonally adjusted annual rate of 676,000 homes after falling to a downwardly revised number in May. Inventory rose slightly to 353,000 new homes but remains low at a 6.3-month supply. Nevertheless, inventory is 46.5% higher than it was in June 2020. Inventory of homes available for sale but not yet under construction was up 84% year-over-year, a clear sign of supply-side limitations in the building market. The inventory of completed homes that are ready to occupy was down 44% year over year, to just 36,000 homes. The median sales price was $361,800, up 6% from May 2020. NAHB cautioned that the big jumps in year-over-year sales is due to the big slowdown in sales during the initial stages of the pandemic. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously-owned homes, which are calculated when a contract closes. Existing Home Sales Rise 1.4% Existing home sales rose 1.4% in June to a seasonally adjusted annual rate of 5.86 million homes after falling for the previous four months, according to the National Association of Realtors (NAR). Sales were up 22.9% from June 2020. The increase in sales comes as inventory levels continue to slowly climb. Total inventories rose 3.3% in June to 1.25 million and have risen month to month for four consecutive months. Housing supplies remain very low, with inventories down 18.8% over the past year. Unsold inventory sits at a 2.6-month supply; inventory has risen by a 0.1-month supply for the past two months. However, inventory is still down from 3.9 months in June 2020. The median existing single-family home price was $370,600 in June, up from $356,600 in May and up 24.4% from June 2020. It was the 112th monthly increase in year-over-year prices. Regional sales were mixed. Regional Housing Data Remodeling Index Rises to 87 The Remodeling Index (RMI) rose 14 points to 87 in the second quarter, according to the National Association of Home Builders. Remodelers in many parts of the country are experiencing very strong demand and the backlog of projects in the pipeline continues to grow. The RMI asks remodelers to rate five components of the index on a scale of 0 to 100. Current Conditions rose 14 points to 91 compared to Q2 last year, Future Indicators rose 13 points to 83, Leads and Inquiries rose 9 points to 81 and the Backlog of Jobs jumped 19 points to 86. Like builders, remodelers are dealing with material shortages and price increases; the price of OSB is up more than 500% from January 2020. The RMI was redesigned in 2020 to make it easier to respond to an interpret, so it’s not possible to track quarterly trends. Mortgage Rates Fall to 2.8%

© Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|