|

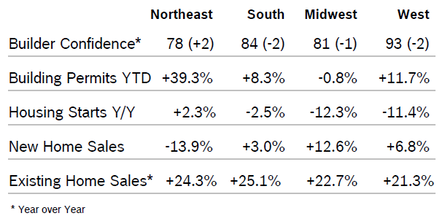

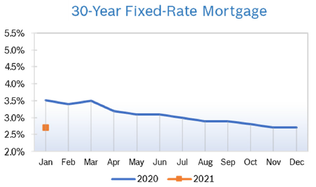

Builder Confidence Falls to 72 Builder confidence dropped two points to 72 in March after dropping one point to 74 in February, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). The HMI index charting current sales conditions fell two points to 79, the index gauging sales expectations in the next six months fell four points to 75 and the index measuring traffic of prospective buyers dropped one point to 56. NAHB cautioned that half of the builder responses in the March HMI were collected prior to March 4, so the recent stock market declines and the rising economic impact of CV19 will be reflected more in the April report. Overall, 21% of builders in the survey reported some disruption in supply due to CV19 concerns in other countries such as China. However, the incidence is higher (33%) among builders who responded to the survey after March 6, which NAHB says indicates that it is a growing issue. The three-month moving average for builder confidence rose in all regions except the West, where it fell one point. Building Permits Fall 5.5% Building permits fell 5.5% in February to a seasonally adjusted annual rate of 1.46 million units after rising to 1.55 million units in January, which had been the highest level since March 2007. Single-family permits rose 1.7% to one million annual units after rising to 987,000 annual units in January. Multifamily permits dropped 18.3% to 460,000 units after rising to 564,000 units in January. Year-to-date permits dropped in all regions. Housing Starts Fall 1.5% Housing starts fell 1.5% in February to a seasonally adjusted annual rate of 1.60 million units after rising to an upwardly revised number in January. Single-family starts rose 6.7% to 1.07 million units after dropping to 1.01 million units in January. Multifamily starts fell 14.9% to 527,000 units after rising to 557,000 units in January. Regional housing starts were mixed. The NAHB cautioned that housing numbers are backward-looking indicators and CV19 will certainly impact the housing market going forward. New-Home Sales Fall 4.4% New-home sales fell 4.4% in February to a seasonally adjusted annual rate of 765,000 new homes after January sales were revised sharply upwards. Sales were up 14.3% from February 2019. The inventory of new homes for sale fell to 319,000, a 5-months’ supply at the current sales pace, down from 5.1 months in January. Supplies were down 6.7% from February 2019. The median sales price fell to $345,900 in February after rising to $348,200 and was up from $320,800 in February 2019. Regional new home sales year to date were mixed. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously-owned homes, which are calculated when a contract closes. Existing Home Sales Jump 6.5% Existing home sales jumped 6.5% in February to a seasonally adjusted annual rate of 5.77 million homes after falling to 5.46 million homes in January. Existing home sales were up 7.2% from February 2019. It was the strongest pace of sales since 2007. NAR said the surging sales were due to incredibly low mortgage rates and pent-up demand. The median home price rose 8% from February 2019 to $270,100, marking 96 consecutive months of year-over-year gains. Total housing inventory at the end of February rose 5.0% to 1.47 million units, but was down 9.8% from February 2019. Unsold inventory remained at a 3.1-months’ supply at the current sales pace, down from 3.6 months in February 2019. Regional existing homes sales year over year were up in all regions; regional sales compared to February 2019 were mixed. Regional Housing Data February 2020 Mortgage Rates Rise to 3.5%

FHFA Boosts Mortgage Liquidity The Federal Housing Finance Agency (FHFA) authorized Fannie Mae and Freddie Mac to enter into additional dollar roll transactions to boost liquidity in the mortgage market. Dollar roll transactions provide mortgage-backed securities investors with short-term financing of their positions, providing liquidity to these investors. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|