|

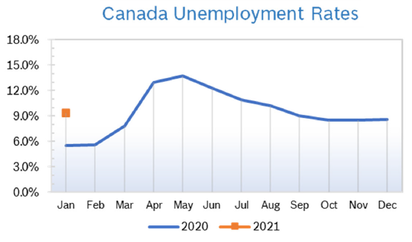

Unemployment Falls to 9.0%

Consumer Confidence Rises to 83.6 The Index of Consumer Confidence inched up 5.2 points to 83.6 in September, according to the Conference Board of Canada. Consumers were more optimistic in general. However, despite this month’s uptick, the pace of the recovery of consumer confidence has stalled. The confidence index has been fluctuating around the 80 mark for four consecutive months. Compared with its peak, reached in February (120.6), the index is now 37 points below its pre-pandemic level. The monthly Index of Consumer Confidence is constructed from responses to four attitudinal questions posed to a random sample of Canadian households. Consumer Prices Rise 0.1% The Consumer Price Index (CPI) rose 0.1% on a year-over-year basis in August, matching the increase in July. Economist had expected prices to increase 0.4% Excluding gasoline, the consumer price index rose 0.6% in August. Regionally, prices rose the fastest in Prince Edward Island. Statistics Canada continued to rely on telephone and the internet, rather than the in-person interviews that are typically done, due to CV19 restriction. Despite the increase, economists expect inflation to remain below the Bank of Canada’s (BoC’s) target of 2%. The average of Canada’s three measures for core inflation was 1.7%. Economists noted that despite the rebound, prices have a long way to go to recover. For the year, the Conference Board now expects consumer prices to rise just 1.1%. GDP Grow 3.0% in July GDP grew 3.0% in July after growing 6.5% in June, according to Statistics Canada. The third consecutive monthly gain left the Canadian economy just 6% below February’s pre-pandemic level. All 20 sectors of the economy grew, as businesses continued to reopen and tried to get back to some sense of normal after lockdowns in March and April. Retail trade continued to improve and surpassed pre-pandemic levels but sales at building material and garden equipment and supplies stores fell 10.2%. Construction grew 0.6% in July as gains in residential (+2.4%) and repair (+2.5%) construction more than offset lower nonresidential construction (-3.0%) and engineering and other construction (-0.5%). Statistics Canada expects growth to slow in August, with the economy growing just 1.0%. Interest Rates Remain Low The Bank of Canada (BoC) held the key interest rate at 0.25% in September and warned that all indicators point to a slow and choppy recovery despite the big third-quarter rebound. The rebound in employment has been uneven, energy prices remain weak, exports remain below pre-pandemic levels and business confidence and investment remain subdued. Experts suggest that the BoC’s key rate could stay where it is until late 2022 or into 2023, based on the pace of the recovery, which is largely dependent on the course of the pandemic. Lower rates help drive down rates of mortgages and loans and make it easier for people to borrow and spend, which aids the recovery. Housing and Construction News The annual pace of housing starts rose 7% in August to a seasonally adjusted annual rate of 262,396 units after jumping to 245,604 units in July, according to Canada Mortgage and Housing Corp. (CMHC). Higher multifamily starts in Ontario, including Toronto, drove the national increase with cities in Quebec and Ontario leading the country in terms of the volume of new homes under construction. It was a very strong showing, and well above expectations. Canada’s home sales continued to climb in August, rising 6.2% to 55,962 homes on a seasonally adjusted basis. It was the fourth consecutive month home sales have risen. Sales were up were up 1.7% from July and 9.4% from August 2019. The Canadian Real Estate Association (CREA) noted it was the second consecutive month that home resales and the price index have both hit record highs. The number of new listings increased 10.6% from July to August. Real estate analysts say that the government restrictions that slowed sales over eight weeks between March and May led to pent up demand that is causing a surge in sales now. The demand for bigger properties and green space has increased sales of homes in the country’s biggest urban areas, as well as less pricey regions such as Niagara, Hamilton and Burlington in Ontario. Meanwhile, condo sales have fallen, with less new supply and less demand. July Retail Sales Rise 0.6% Retail sales rose 0.6% to $52.9 billion in July, led by higher sales at motor vehicle and parts dealers and gasoline stations. Core retail sales, which exclude these two subsectors, declined 1.2% on lower sales (-11.6%) at building material and garden equipment and supplies dealers as well as at food and beverage stores. Retail sales soared in June after three months of declines. Only 3% of retailers remained closed in July. Sales rose in five provinces. Retail Ecommerce Sales Rise On an unadjusted basis, retail ecommerce sales were $2.8 billion in July, accounting for 4.8% of total retail trade. The percentage of retail sales accounted for by ecommerce has dropped since stores began reopening, but is still 1.7% above July 2019 levels. On a year-over-year basis, retail ecommerce sales have jumped 63.2%, while total unadjusted retail sales have increased 5.6%. When adjusted for basic seasonal effects, retail e-commerce decreased 8.1% in July. Retail Notes Lowe’s Canada launched a VIPpro program at Lowe’s, RONA and Reno-Depot corporate stores. The new program will offer Lowe's Canada’s Pro customers a better, more integrated and more flexible purchasing experience, with extra benefits , discounts and advantages that will be offered across all the stores regardless of the store banner. Lowe’s Canada operates more than 235 corporate stores of various formats under three different banners; Pros will get the same benefits no matter where they shop. Some of the benefits include a 5% discount on everything (10% on paint), dedicated customer service, bulk discounts, early opening hours, priority curbside pickup, flexible site delivery options and a 365-day return policy and price guarantee. Lowe’s also officially launched the VIPpro app that allows members to view their data, special offers and profile info on their mobile device at all times as well as provides access to exclusive deals, managed employee access, links and a store locator. Lowe’s Canada is recruiting for about 625 jobs in RONA and Reno-Depot stores in Quebec for full-time and part-time positions in stores and also in one of the distribution centres. Amazon will open two new fulfillment centers in Ontario next year, a move they say will create 2,500 jobs. Canadian Tire (CTC) is partnering with cloud-based artificial intelligence (AI) provider Medallia in order to gain real-time insights into the complete customer experience across all of its banners. CTC says that they are working towards creating a seamless customer experience. Canadian Tire operates more than 1,700 retail and gasoline outlets across Canada. East Ontario paramedics will open drive-thru testing centers for coronavirus at Canadian Tire Centers in order to take some of the pressure off Ottawa’s jammed testing system. Amazon plans to hire 3,500 Canadians as they expand their offices in British Columbia and Ontario. About 3,000 jobs will be in Vancouver, where Amazon is expanding their offices at the Post building. They will also be leasing new office space in Toronto, where they’ll be adding 500 workers. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

Archives

July 2024

|