|

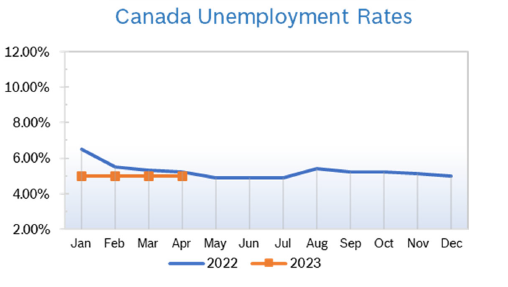

Unemployment Holds at 5.0% in April

Consumer Prices Rise 4.4% Consumer prices were up 4.4% year over year in April after being up 4.3% in March. It was the first year over year increase since inflation peaked at 8.1% in June 2022. Statistics Canada said the increase in inflation for April was driven by higher mortgage interest costs. Interest costs were up 28.5% compared with a year ago as both new homebuyers and people renewing mortgages faced higher interest rates. A 6.1% increase in rent prices also helped push up the overall rate. While the Bank of Canada (BoC) targets 2% annual inflation, their target for this year is to get inflation down into the 3% range. Housing and Construction News Housing starts rose 22% in April to a seasonally adjusted annual rate of 261,559 units after climbing to 213,865 units in March, according to Canada Mortgage and Housing Corp. (CMHC). The increase was driven by a big jump in urban starts. Single-family starts fell 2% to 39,964. The six-month moving average of the monthly seasonally adjusted annual rate was 240,403 units in April, down 0.2% from 240,876 units in March. Canadian home sales jumped 11.3% in April after rising 1.4% in March, according to the Canadian Real Estate Association (CREA). Although it was the third consecutive month of higher sales, the actual number of homes sold in April was down 19.5% from April 2022. The year-over-year sales decline was markedly smaller than the drops reported in recent months. Retail Sales Retail sales decreased 1.4% in March to $65.3 billion after dropping to $66.3 billion in February. Sales fell in 5 of the 9 subsectors, representing 55.5% of retail trade. Core retail sales, which exclude gasoline stations, fuel vendors and motor vehicle and parts dealers, increased 0.3% in March. Gains were led by a 1.6% increase in sales at building and garden supplies and materials dealers. In volume terms, retail sales decreased 1.0% in March. Retail sales fell in all provinces except British Columbia. Retail sales were up 0.7% in the first quarter of 2023 and 1.2% in volume terms. Q1 GDP Rises 0.8% Real GDP rose 0.8% in the first quarter of 2023 after being unchanged in the fourth quarter. Favorable international trade and growth in household spending were moderated by slower inventory accumulations as well as declines in housing investment and business investment in machinery and equipment. Final domestic demand increased 0.7% in the first quarter of 2023 after remaining flat in the fourth quarter of 2022. Household spending rose for both goods and services. Housing investment continued to decline, falling 3.9% in the first quarter as borrowing costs rose and mortgage originations fell. It was the fourth consecutive quarter household spending fell. The decline was widespread, with new construction falling 6.0%, renovations dropping 2.1% and transfer costs, an indication of resale activity, fell 1.5%. New construction fell in all provinces except the Yukon. Both household disposable income and corporate income fell. Retail Ecommerce Sales On a seasonally adjusted basis, retail ecommerce sales were up 2.2% in March to $3.8 billion, accounting for 5.9% of total retail trade, compared with 5.7% in February. Retail Notes Canadian Tire Q1 revenue fell 4.9% to $3,707.2 million. Financial services segment revenue growth partially offset the retail segment decline, which was mainly due to lower revenue at Canadian Tire retail. Canadian Tire retail comp sales were down 4.8% for the first quarter. Lower sales of winter and spring products were partially offset by growth in non-winter related automotive categories and in living categories. Canadian Tire noted that consumers were shifting from discretionary purchases to trying to save money on essentials and also shifting spending to activities that were curtailed during the pandemic, including travel and dining out. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

Archives

July 2024

|