|

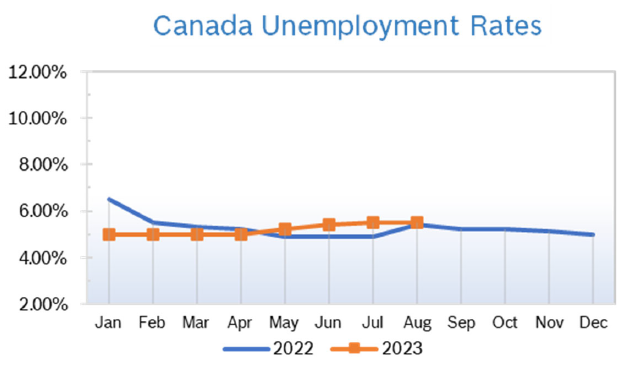

Unemployment Remains at 5.5%

Consumer Prices Consumer prices were up 3.3% year over year in July after being up 2.8% year over year in June; prices were up 0.6% for the month from June. The increase was below estimates, and the smallest increase since March 2021. The slowdown was largely driven by lower year-over-year prices for gasoline and cell phone services. While the cost of groceries and mortgages continues to rise, it was the first time since 2021 interest rates have been within the Bank of Canada’s acceptable range of below 3.0%. Inflation has exceeded the bank’s target rate for the past two years. Central bank economists expect inflation to fall rapidly in the coming months, but it may take longer for interest rates to come down. Housing and Construction News July housing starts fell 10% to 254,966 starts from June, the year's strongest month so far, but year-over-year starts were 7.4% above July 2022. The annual pace of housing starts in urban areas fell 11% to 234,857, according to data from Canadian Mortgage and Housing Corp. (CMHC). Within this category, the rate of multi-unit starts had a sharper drop of 12% to 193,446, while the pace of single-detached starts had a more modest decrease of 4% to 41,411. Nova Scotia, Saskatchewan, B.C. and Ontario all posted double-digit declines in construction activity, while P.E.I., Alberta and Manitoba had the strongest gains. Canadian home sales fell 0.7% in July after rising 1.5% in June but were up a strong 8.7% from July 2022, the largest year-over-year increase in two years, according to the Canadian Real Estate Association (CREA). The national average home price rose 6.3% to $668,754. Analysts described the market as stabilizing. The CREA still expects about 464,000 properties to be resold via the Canadian MLS systems in 2023, down from April's forecast of 492,674 properties. The new tally is 6.8% below 2022 levels. The downgrade from the previous two forecasts is broadly based as CREA expects the sales rebound to be cut short by the rising cost of borrowing. The forecast sales would be in line with the 10-year average, but below 2007, 2016, 2020 and 2021. GDP Unchanged in Q2 GDP remained largely unchanged in Q2 after rising 0.6% in the first quarter. The slowdown was due to continued declines in housing investment, smaller inventory accumulation, slowing international exports and falling household spending. Increased business investment in engineering structures and higher government spending were among the few components that contributed to growth. Housing investment fell 2.1% in the second quarter, the fifth consecutive quarterly decrease. The decline was led by a sharp drop in new construction (-8.2%) in all provinces and territories other than Nova Scotia. Renovation activities (-4.3%) also fell. Falling housing investment coincided with higher borrowing costs and lower demand for mortgage funds, as the Bank of Canada continued their monetary tightening, raising the policy interest rate to 4.75% in the second quarter. Growth in real household spending slowed to 0.1% in the second quarter from 1.2% in the first quarter. Household spending on services was unchanged in the second quarter, following a 1.1% rise in the first quarter. Compensation of employees rose 2.2% in the second quarter, following a 1.9% increase in the previous quarter. Increases in compensation of employees was mainly due to higher average wages. Retail Sales Retail sales rose 0.1% in June to $65.9 billion after rising to $66.0 billion in May. Sales increased in three of nine subsectors and were led by a 2.5% increase at motor vehicle and parts dealers. Core retail sales, which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers, fell 0.9% in June after falling in May. In volume terms, retail sales edged down 0.2% in June. Retail sales were unchanged in the second quarter but dropped 0.8% in volume terms. Sales increased in five of nine subsectors. Retail Ecommerce Sales Retail ecommerce sales were up 1.1% to $3.7 billion in June, accounting for 5.7% of total retail trade, compared with 5.6% in May. Retail Notes Canadian Tire reported Q2 sales fell 3% to $4.26 billion and comp sales were flat. CEO Greg Hicks said inflation and rate hikes impacted consumer demand for sporting goods, home improvement supplies and other non-essential items, especially in the second half of the quarter. A fire at a major Toronto distribution centre in March cost $74.6 million and impacted revenue and profits. CT also withdrew their 3-year forecast, saying inflation has dampened consumer spending and put pressure on retail sales, creating what CEO Greg Hicks termed a “turning point for the Canadian economy.” © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

Archives

July 2024

|