|

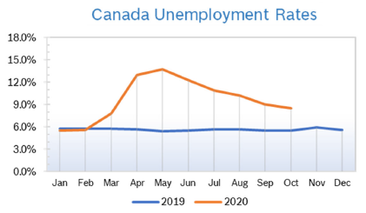

Unemployment Drops to 8.5%

Consumer Confidence Remains at 74.1 The Index of Consumer Confidence remained at 74.1 in November after falling 9.5 points in October, according to the Conference Board of Canada. CV19 cases surged in multiple provinces in November. As the pandemic lingers, more Canadians expect their future finances and job prospects to remain the same in six months. Compared with its peak, reached in February (120.6), the index is now 46.5 points below its pre-pandemic level. The monthly Index of Consumer Confidence is constructed from responses to four attitudinal questions posed to a random sample of Canadian households. Consumer Prices Rise 0.7% The Consumer Price Index (CPI) rose 0.7% on a year-over-year basis in October after rising 0.5% in September. Economists had expected prices to increase 0.4%. On a seasonally adjusted monthly basis the CPI rose 0.3% in September. Prices rose year over year for five of the eight major components. Regionally, prices rose in all provinces. Lower interest rates continued to coincide with increased demand for single-family homes. This, along with higher building material costs and low inventory of homes for sale, contributed to higher costs for new housing, with new home prices increasing at their fastest pace in 14 years. The homeowners' replacement cost index, which is derived from the price of new homes, rose 1.4% month over month, the largest monthly increase since June 1991. Despite the increase, economists expect inflation to remain below the Bank of Canada’s (BoC’s) target of 2%. Economists noted that despite the rebound, prices have a long way to go to recover. For the year, the Conference Board now expects consumer prices to rise just 1.1%. Q3 GDP Grows 8.9% GDP grew 8.9% in the third quarter, following an 11.3% drop in the second quarter and a 1.9% decline in the first, according to Statistics Canada. Despite record-setting growth in the third quarter, real GDP was down 5.3% compared with the fourth quarter of 2019.The increase in GDP in the third quarter reflected reopening of the economy, with substantial upturns in housing investment, household spending on durable goods, and exports. These upturns were influenced by favorable mortgage rates, governments' continued support to households and businesses affected by the pandemic and growth in major trading partners' economies in the third quarter. Despite the rebound, household spending was down 5.0% compared with the fourth quarter of 2019. Purchases of automobiles and trucks sent durable goods purchases skyrocketing. Outlays for services rose 9.6% after falling in the second quarter, aided by the popularity of outdoor dining, but were still down 12.4% from the fourth quarter of 2019. Housing investment rose 30.2%, after declining 15.0% in the second quarter. Compared with the fourth quarter of 2019, housing investment was up 10.3%. Housing spending was driven by existing home sales as well as a 9.7% jump in new construction, combined with low mortgage rates, improved job market conditions and rising wages. Business investments in non-residential buildings, machinery and equipment and intellectual property products all rebounded, but remained below pre-pandemic levels. Canadians recorded another quarter of strong saving. The savings rate stood at 14.6%, down from a record 27.5% in the second quarter, but significantly higher than the fourth quarter of 2019, at 2.0%. Housing and Construction News The annual pace of housing starts rose 35% in October to a seasonally adjusted annual rate of 214,875 units, somewhat below expectations. Single-detached homes in cities such as Toronto and Montreal contributed to the upswing in starts. The six-month moving average rose slightly in October to 222,734 units. Canada Mortgage and Housing Corp. (CMHC) expects starts to trend lower by the end of the year as a result of the negative impact of CV19 on economic and housing indicators. Moving forward, they expect housing starts to remain elevated through next year, as issuance of permits has remained strong and mortgage rates are low. Canada’s home sales slipped 0.7% in October after rising 0.9% in September and were up 32.1% from October 2019. Nevertheless, sales set a record for October. The national average home price also set another October record at $607,250, up 15.2% from October 2019. Excluding sales in the pricey Greater Vancouver and Greater Toronto areas, the national average price was about $480,000. 2020 is on track to be the most active year in Canadian real estate history, most likely due to the number of people abandoning urban living and working from home combined with low interest rates. In the first 10 months of the year, 461,818 homes were sold over Canada's MLS system, an 8.6% increase from the same time period in 2019. Mortgage Rates Could Head Higher Five-year fixed mortgage rates could increase soon, according to multiple Canadian brokers who say lenders have notified them of potential hikes. Five-year fixed rates are correlated with the yield of the Canada five-year bond, which rose from 0.39% to 0.48% on news that Pfizer’s CV19 vaccine showed a 90% efficiency rate in Phase 3 trials. If the yield holds, an increase of 10 to 20 basis points would be rolled out. Canadians have traditionally favored variable rate mortgages. Retail Sales Rise 0.4% Retail sales rose 1.1% to $53.9 billion in September, the fifth consecutive monthly increase since the record decline in April. Core retail sales, which exclude gasoline stations and motor vehicle and parts dealers, also rose 1.1%, on higher sales at general merchandise stores and food and beverage stores. Retail sales were up in 9 of 11 subsectors, representing 93.2% of retail trade. In volume terms, sales were up 1.1% in September. Rounding out the third quarter, retail sales were up 22.6% compared with the second quarter. In volume terms, retail sales rose 21.5%. Sales were up in eight provinces. Note: Canadian retail sales do not include spending on food services. Retail Ecommerce Sales Rise On an unadjusted basis, retail ecommerce sales reached $3.2 billion in September, accounting for 5.6% of total retail trade. The share of ecommerce sales out of total retail sales rose 0.5% from August despite more retailers expanding in-person shopping and was up 2.1% year over year. Retail ecommerce sales were up 74.3% year over year in September, while total unadjusted retail sales increased 9.3%. When adjusted for basic seasonal effects, retail e-commerce rose 8.1% Retail Notes Canadian Tire’s Q3 revenue rose 9.6% to $3.99 billion and comp sales jumped 18.9%. Online sales grew 178%, and foot traffic in stores as well as curbside pickup grew. Canadian Tire President and CEO Greg Hicks said that CV19 has encouraged more one-stop shopping and a larger “basket size” as shoppers stock up and try to avoid multiple trips to the store. Canadian Tire will take a more cautious approach to holiday promotions in an effort to prevent surges in traffic and maintain physical distancing in stores Canadian retailers and package carriers such as Canada Post have implored people to shop early as they brace for a huge increase in ecommerce and packages being shipped. They plan to offer competitive deals, but to stagger them out over longer periods in order to avoid concentrating traffic in the store. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

Archives

July 2024

|