|

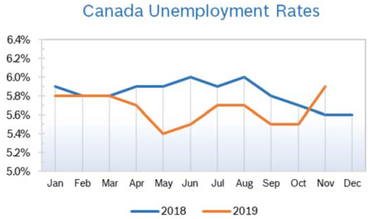

Unemployment Rises to 5.9%

Consumer Confidence Falls to 109.2 The Index of consumer confidence fell 2.2 points in October to 109.2, its lowest level since the end of 2018, according to the Conference Board of Canada. The monthly Index of Consumer Confidence is constructed from responses to four attitudinal questions posed to a random sample of Canadian households. Consumer Prices The Consumer Price Index (CPI) rose 1.9% year over year in October, matching the increase for both August and September, according to Statistics Canada. Excluding gasoline, the index was up 2.3% year over year after three consecutive months of 2.4% increases. On a seasonally adjusted annual basis the index rose 0.3% in October after edging down 0.1% in September and August. The upward pressure on consumer prices is not great enough to spur the BoC to consider an increase in interest rates, although the BoC did not cut rates at the end of October as many had predicted. The eight components of the CPI were mixed in October, with some rising and some falling. GDP Rises 0.1% Canadian GDP rose 0.1% in September after rising by the same percentage in August, according to Statistics Canada. There were gains in 13 of 20 industrial sectors, with increases in wholesale trade and construction offset in part by lower activity in rail transportation. The construction sector was up 0.6% in September with increases in all of its subsectors. Residential construction rose 1.0%, fully offsetting the declines of the previous two months, as growth in home alterations and improvements along with multiunit dwellings construction more than offset lower construction of single, double and row-housing units. Non-residential construction grew 0.5%, led by an increase in industrial and commercial construction. Repair construction increased 0.5%, while engineering and other construction was up 0.2%. For the third quarter, construction was up 1.8%, the largest quarterly gain since the fourth quarter of 2017, with growth in all types of construction. Residential construction was up 1.7% from increases in single, double and apartment-type dwellings. Non-residential construction rose 1.3% as activity in commercial and public sectors construction increased. Repair construction was up 0.4%. The manufacturing sector contracted 0.2% in September, the third decrease in four months, as growth of 0.3% in durable manufacturing was offset by a 0.7% decline in non-durable manufacturing. Retail trade was unchanged in September. GDP Forecast The Bank of Canada (BoC) forecasts that real GDP will grow by 1.5% in 2019, 1.7% in 2020 and 1.8% in 2021. Measures of inflation are all around 2%, with CPI inflation dipping temporarily in 2020 as the effects of a spike in energy prices fade. Housing and Construction News Housing starts fell to 201,973 units in October compared to 221,135 in September, below economists expectations. The decline came as the pace of urban starts dropped 9%. Within urban starts, single-detached homes rose 2.4% to 49,786 units. Canada’s home sales held steady in October compared to September and were up 12.9% from October 2018, according to the Canadian Real Estate Association (CREA). Home sales were almost 20% above the six-year low reached in February of this year but are still 7% below highs reached in 2016 and 2017 before mortgage regulations were tightened. Inventory was at a 4.4-months’ supply, the lowest level since April 2017. Retail Sales Retail sales edged down 0.1% in September to $51.6 billion after sales for August were revised upwards. Excluding motor vehicles and gas, sales rose 0.7%. Sales overall were up 0.5% for the third quarter after being up 1.1% in the second quarter. Sales at building material and garden equipment and supplies dealers rose 3.3%. Sales were up at home centres and building materials stores. Sales were down in seven provinces but rose in Quebec and Ontario. On a year-over-year basis, retail ecommerce sales were $1.9 billion, accounting for 3.6% of total retail trade. Ecommerce sales were up 34.6% year over year, while total unadjusted retail sales were up 0.7%. Retail Notes Home improvement retail sales totaled $50 billion in Canada last year, according to Hardlines Information Group, which expects sales to grow 3.2% this year and 4% in 2020. Lowe’s announced that disappointing Q3 results in Canada will result in a reorganization of their corporate support structure across Canada. They plan to migrate Canada to the IT platform used in the US Lowe’s is committed to the Canadian market and will be taking decisive action to eliminate inefficiencies and unnecessary technology duplication, improve customer service and make their Canadian operations profitable. Lowe’s is closing 34 stores across six provinces and cutting jobs in Canada. Quebec, the birthplace of Rona, will see the most closures, with 12 Rona and Reno-Depot outlets expected to close early next year. Lowe’s currently operates about 600 corporate and independent affiliate-dealer stores in Canada, including Lowe’s, Rona, Reno-Depot, ACE Canada and Dick’s Lumber. CEO Marvin Ellison blamed the company’s complex operating structure in Canada and says they are trying to simplify things so they can optimize costs. The Globe and Mail recently questioned whether Lowe’s was repeating Target’s mistakes in Canada. The Globe and Mail says Lowe’s is eroding an iconic brand that took nearly 80 years to build. The newspaper went on to say that Target entered the Canadian market with a poor understanding of the cultural differences and competitive dynamics, and Lowe’s seems to be repeating many of the same mistakes in Quebec, where Rona had a very loyal and devoted customer base. One of the reasons that made Rona a target for acquisition was their inability to maintain that brand loyalty as they attempted to expand across Canada. Rona was ordered to stop promoting their stores as “Truly Canadian” and “Proudly Canadian.” Complaints to regulators stated that Rona was owned by a US corporation (Lowe’s) and that the chain is therefore not “Truly Canadian.” Rona was founded in Quebec in 1939 and acquired by Lowe’s in 2016. Amazon will be the top shopping destination for 60% of Canadian consumers, the same percentage who plan to research purchases on the Amazon website. Just 14% of consumers trust influencers and only 6% trust celebrity endorsements, while 72% trust family recommendations and 79% trust the recommendations of friends. Boxing Day/Week in Canada may be losing appeal with only one in three consumers planning to shop these sales. Canadian Tire plans to cut more than $200 million in annual costs by 2022 despite solid third quarter revenue of $3.64 billion, up from $3.63 billion a year ago. Comp sales rose 2.4% at Canadian Tire stores, but revenue from the retail segment overall fell 0.4%. Canadian Tire is working to build their online business, but said that distribution, fulfilment and shipping costs in Canada are high and they need to look at ways to build scale in order to make online sales more profitable. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

Archives

July 2024

|