|

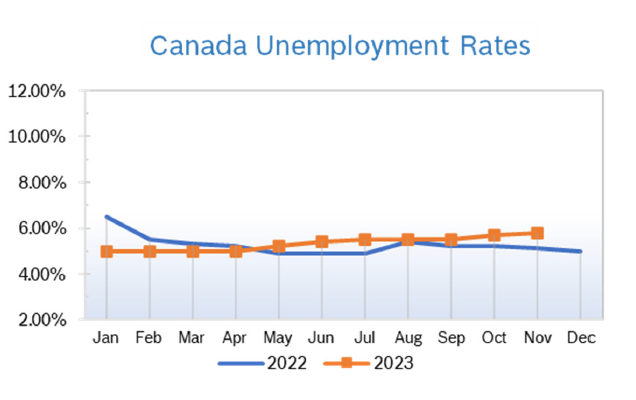

Unemployment Rises to 5.8%

Consumer Prices Rise 3.1% Consumer prices rose 3.1% year over year in October after rising 3.8% year over year in September. The decrease was in line with expectations and largely due to tumbling gas prices. Seasonally adjusted prices fell 0.1% from September. Prices for services and housing are still rising more briskly, making it unlikely the BoC will cut interest rates any time soon but may put a halt to further increases. Housing and Construction News Canadian housing starts rose 1% in October to 674,281 units after jumping 8% in September. Starts increased for both multi-unit and single-family-detached projects, according to the Canadian Mortgage and Housing Corporation (CMHC). Economists had expected starts to fall and do not expect them to remain positive for much longer. Canadian home sales fell 5.6% in October after falling 1.9% in September and were down 0.9% from October 2022, according to the Canadian Real Estate Association (CREA). It was the fourth consecutive monthly decline for existing home sales. The national average home price fell 0.8% between September and October to $655,507 but was up 1.1% from October 2022. S&P Projections 2024 Canadian GDP is expected to grow 0.8% in 2024, according to the latest projection from S&P Global Ratings, which is below the 1.2% forecast in September. S&P Global Ratings also revised their estimate for 2023 GDP growth down to 1.1%. They also think the job market will remain sluggish, with unemployment rising to a 6.1% average in 2024 from a 5.4% average this year. The Bank of Canada is expected to maintain a policy rate of 5% while they let past rate hikes work their way through the economy, although they may begin cutting rates by the second quarter of 2024. Retail Sales Fall 0.6% Retail sales fell 0.6% in September to $66.5 billion after falling to $66.1 billion in August. Sales were up in four out of nine subsectors, led by increases at motor vehicle and parts dealers. Core retail sales, which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers, were down 0.3% for the second consecutive month. In volume terms, retail sales increased 0.3% in September. Retail sales were up 0.6% in the third quarter but declined 0.5% in volume terms. Retail sales increased in eight provinces, with the largest increase in Ontario. Advance indicators point to retail sales rising 0.8% in October. Retail Ecommerce Sales Fall 0.6% Retail ecommerce sales fell 0.6% to $3.8 billion in September, accounting for 5.8% of total retail trade. Retail ecommerce sales fell to $3.9 billion in August. Retail Notes Retailers are expecting a slower holiday season with more intense discounting and promotions as retailers compete for consumer dollars. Canadian Tire’s Q3 revenue rose 0.5% to $4.25 billion, but comp sales fell 1.6%. They laid off about 3% of their workforce and are cutting costs and slowing capital spending as persistent economic pressures continue to impact consumer demand and retail spending. Canadian Tire is cutting back on spending as well. Last year, the company announced a four-year, $3.4-billion investment plan to improve operations and bolster sales, forecasting 4% average sales growth and setting a goal to more than double diluted earnings per share from 2019 to 2025. But in August, they noted a turning point in the economy and withdrew that optimistic forecast and trimmed spending plans. Canadian Tire introduced an e-registry for Christmas gifts called Canada’s Christmas Lists. Customers can build, share, and shop personalized Christmas lists from friends and family. Canadian Tire acquired the Bank of Nova Scotia’s 20% stake in Canadian Tire Financial Services and will bring their financial services unit fully in house. CEO Greg Hicks said that while the partnership had been a fruitful one, it was time for them to be on their own. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

Archives

July 2024

|