|

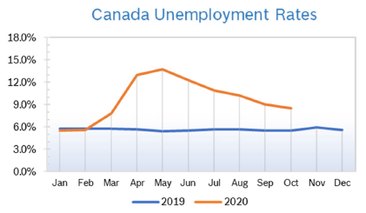

Unemployment Falls to 5.5%

Consumer Confidence Rises to 112.0 The Index of Consumer Confidence rose 12 points in January to 114.0, the highest level since August 2019, according to the Conference Board of Canada. The monthly Index of Consumer Confidence is constructed from responses to four attitudinal questions posed to a random sample of Canadian households. Consumer Prices Rise 2.2% The Consumer Price Index (CPI) rose 2.2% year over year in December after rising 2.2% in November, according to Statistics Canada. Excluding gasoline, the index was up 2.0% year over year. On a seasonally adjusted annual basis the index rose 0.4% in December after rising 0.1% in November. Prices were up on a year-over-year basis in five provinces. Fuel and energy prices increased in all provinces. GDP Rises 0.1% GDP edged up 0.1% in November after falling in October, according to Statistics Canada. Increases in 15 of 20 industrial sectors more than offset notable declines in the mining, quarrying and oil and gas extraction and transportation and warehousing sectors, influenced partly by disruptions in rail transportation service and crude oil pipeline transportation. Goods-producing industries rose 0.1% after falling in September and October, while services-producing industries also edged up 0.1%. After three months of stagnation the construction sector was up 0.5% in November, with growth in all subsectors. Residential construction rose 0.6% due to strength in alterations and improvements and apartment construction. Non-residential construction grew 0.4% because of a rise in the commercial sector. Both repair construction and engineering and other construction activities increased 0.4%. After a widespread 1.1% decline in October, retail trade increased 0.5% in November with gains in 5 of 12 subsectors. Building materials, garden equipment and supplies stores grew 2.7%, the first increase in four months. On a three-month rolling average basis, GDP was up 0.1% after increasing 0.2% in October. Interest Rates Unchanged at 1.75% The Bank of Canada (BOC) left its key interest rate unchanged at 1.75% in January and cut estimates for near-term growth, leaving the door open to a future interest rate cut if the economy needs a boost. The decision was widely expected. A decline in exports and business investment and job creation plus a drop in residential investment figured into the decision. Economists said the tone of the bank’s remarks indicates they are more concerned than they were last year that there may be a need to cut rates. They downgraded their fourth-quarter growth forecast to 0.3% on an annualized basis and dropped their forecast for GDP growth by about three-quarters of a point, to 1.3% in the first quarter. Bank of Canada Surveys Consumers and businesses remain confident, according to the most recent quarterly surveys from the Bank of Canada. Their Business Outlook Survey suggests that business demand is growing with companies reporting rising pressures in production capacity and labour shortages in much of the country, with the exception of the Prairies. The bank published their Canadian Survey of Consumer Expectations for the first time, which showed that consumers remain upbeat about spending plans this year despite a mixed outlook for employment and modest wage growth expectations. Consumers expect home prices to accelerate. More companies expect to increase staff this year and expect sales to grow at a more robust pace. Housing and Construction News Housing starts slowed during the last quarter of 2019, falling 3% in December to a seasonally adjusted annual rate of 197,329, driven largely by a decline in new construction of condos and apartments in Toronto, Ottawa and Montreal, according to Canada Mortgage and Housing Corp (CMHC). CMHC forecasts a rebound in housing starts this year to as high as 204,300 units across the country, due to population growth, rising incomes and strong employment in British Columbia and Ontario. CMHC is forecasting a rise in housing starts in Ontario, B.C., Alberta, Saskatchewan and Manitoba, but slower activity in Quebec and Atlantic Canada due to fewer people forming households. Canada’s home sales fell 0.9% in December but were up 22.7% compared to December 2018, according to the Canadian Real Estate Association (CREA). The decline ended a streak of monthly gains that began last March. The national average price for a home sold in December 2019 was $517,000, up 9.6% compared to December 2018. Excluding the Greater Vancouver and Greater Toronto areas, two of the country’s most active and expensive housing markets, the average price of a home sold was about $400,000, up 6.7% compared to December 2018. Inventory was at the lowest point since the summer of 2007, with 4.2 months of inventory based on the current sales pace, well below the long-term average of 5.3 months. CREA expects home sales to rise 8.9% in 2020 to 530,000 units and forecasts the average price will rise 6.2% to $531,000. They expect sales will benefit from job growth and population gains and also get a modest boost from government programs for first-time home buyers. Retail Sales Rise 0.9% Retail sales rose 0.9% in November to $55 billion after dropping 1.1% to $50.9 billion in October. The increase was primarily due to higher sales at motor vehicle and parts dealers and food and beverage stores. Higher sales were reported in 6 of 11 subsectors, representing 70% of retail trade. After removing the effects of price changes, retail sales in volume terms rose 0.7%. Sales at building material and garden equipment and supplies dealers rose 2.1%, the first increase in the category in the last five months. Sales were up in six provinces and all census metropolitan areas. Retail sales continued on a downward trend in Alberta. On an unadjusted basis, retail ecommerce sales were $2.4 billion in November, accounting for 4.4% of total retail trade and were up 6.6% year over year, while total unadjusted retail sales were up 2.2%. Retail Notes Canada is partnering with Canadian Tire to build 54 electric vehicle fast chargers at Canadian Tire locations across central and western Canada. The $2.7-million program is designed to encourage people to use electric and alternative fuel vehicles. Anthony Hurst, the head of Lowe’s Western region, will become the new president of Lowe’s Canadian operations in mid-February. He becomes the first permanent country president since Sylvain Prudhomme retired last year. Hurst has 25 years of retail and home improvement experience, including Home Depot. Lowe’s has more than 26,000 employees in Canada. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

Archives

July 2024

|