|

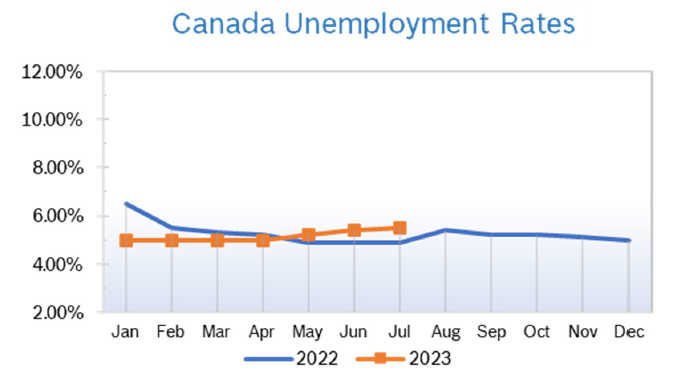

Unemployment Rises to 5.5% in July

Consumer Prices Rise 2.8% Consumer prices were up 2.8% year over year in June after being up 3.4% year over year in May. The increase was below estimates, and the smallest increase since March 2021. The slowdown was largely driven by lower year-over-year prices for gasoline and cell phone services. While the cost of groceries and mortgages continues to rise, it was the first time since 2021 interest rates have been within the Bank of Canada’s acceptable range of below 3.0%. Inflation has exceeded the bank’s target rate for the past two years. Central bank economists expect inflation to fall rapidly in the coming months, but it may take longer for interest rates to come down. BoC Raises Rates to 5.0% The Bank of Canada (BoC) was widely criticized for bumping up rates another quarter-point in July to 5.0%, the highest level since 2001, after raising rates a quarter-point in June. The BoC had previously signaled that rate increases were likely on hold for the foreseeable future. The move was in response to Canada’s surprisingly strong economy and fears that inflation might heat up. Analysts are speculating that the BoC may actually be done raising rates now. Housing and Construction News The six-month trend for housing starts rose 2.4% in June to a seasonally adjusted annual rate of 234,974 units after dropping to a seasonally adjusted annual rate of 202,494 units in May. It was the largest month-to-month gain in ten years, according to the Canadian Mortgage and Housing Corporation (CMHC). The seasonally adjusted rate of total housing starts for all areas in Canada jumped by 41% in June to 281,373 units from 200,018 units in May. Actual total housing starts jumped by more than 7,000 units to 23,518 from 15,889 in May, largely due to an increase in multi-unit starts, but remained slightly below last year's level. Vancouver and Toronto saw the largest increases. Canadian home sales rose 1.5% in June from May and were up 4.7% on an annual basis, according to the Canadian Real Estate Association (CREA). The Home Price Index rose 2% for the month but was down 4.75% annually; the average selling price was up 6.7% year over year. The CREA now expects about 464,000 properties to be resold via the Canadian MLS systems in 2023, down from April's forecast of 492,674 properties. The new tally is 6.8% below 2022 levels. The downgrade from the previous two forecasts is broadly based as CREA expects the sales rebound to be cut short by the rising cost of borrowing. The forecast sales would be in line with the 10-year average, but below 2007, 2016, 2020 and 2021. GDP Rises 0.3% GDP increased 0.3% in May, following a 0.1% uptick in April. Services-producing industries were up 0.5%, while goods-producing industries partially offset the increase with a 0.3% decline in May. Overall, 12 of 20 industrial sectors posted increases. Energy-sector industries are being negatively impacted by Canada’s widespread forest fires. Manufacturing and wholesale sectors grew as pandemic-era supply chain restrictions eased. The construction sector shrank 0.8% in May after increasing 0.2% in April as almost all subsectors posted declines. Residential building construction (-1.8%) contributed the most to the decrease, driven by declines in home alterations and improvement and construction of new single-detached homes. Retail Sales Rise 0.2% Retail sales rose 0.2% in May to $66.0 billion. Sales increased in five of nine subsectors. Core retail sales, which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers, were unchanged in May. In volume terms, retail sales increased 0.1% in May after rising 0.3% in April. While some sectors gained, sales fell 1.5% at building materials and garden equipment and supplies dealers (-1.5%). Sales rose in six provinces. Retail Ecommerce Sales Rise 2.1% On a seasonally adjusted basis, retail ecommerce sales were up 2.1% to $3.7 billion in May, accounting for 5.6% of total retail trade compared with 5.5% in April. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

Archives

July 2024

|