|

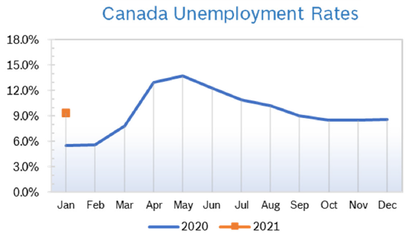

Unemployment Drops to 10.2%

Consumer Confidence Drops to 78.4 The Index of Consumer Confidence declined 4.1 points in August to 78.4, reversing three consecutive months of increasing confidence. Consumers were more pessimistic overall in August, according to the Conference Board of Canada. The monthly Index of Consumer Confidence is constructed from responses to four attitudinal questions posed to a random sample of Canadian households. Consumer Prices Rise 0.7% The Consumer Price Index (CPI) rose 0.1% on a year-over-year basis in July, down from a 0.7% increase in June, according to Statistics Canada. Excluding gasoline, the CPI rose 0.7%. On a seasonally adjusted monthly basis, the CPI fell 0.1% in July. Prices rose year over year for five of the eight major components but price growth slowed. Gasoline prices fell for the fifth consecutive month. Prices rose year over year in five provinces and declined in three of the four Atlantic provinces. In July, measures remained in place across much of the country to restrict gatherings and the movement of people. Statistics Canada continued to rely on telephone and the internet, rather than the in-person interviews that are typically done, due to CV19 restriction. Despite the increase, economists expect inflation to remain below the Bank of Canada’s (BoC’s) target of 2%. Economists noted that despite the rebound, prices have a long way to go to recover. For the year, the Conference Board now expects consumer prices to rise just 1.1%. Quarterly GDP Shrinks 11.5% Real GDP dropped 11.5% in the second quarter, which included the worst of the lockdowns and other measures aimed at controlling CV19. It was the deepest quarterly decline since Statistics Canada began publishing quarterly data in 1961. On an annualized basis, the decline was 38.7%, more severe than the annualized 31.7% plunge reported in the US. Analysts noted Canada’s sharper decline was likely due to the fact that Canada’s lockdown began earlier and imposed stricter measures than were taken in the US. While the slowdown was deep, it was actually at the low end of economists’ expectations, and the resumption of economic activity was stronger than anticipated. Real GDP actually surged 6.5% in June, a one-month record, and well above expectations. Statistics Canada also expects GDP to rise 5% in July. That would leave real GDP up about 15% from the low point in April, and about 6% below the pre-pandemic level in February. Figures for June were also upgraded. That will most likely result in strong numbers for the third quarter. Housing and Construction News The annual pace of housing starts jumped 16% in July to a seasonally adjusted annual rate of 245,604 after increasing 8% in June, according to Canada Mortgage and Housing Corp. (CMHC). It was the highest level since November 2017, and contrary to CMHC’s prediction of a huge decline in building. Starts jumped in pricey Toronto as well as in more affordable areas outside of the city. New construction jumped from June to July in Calgary, Edmonton and Saskatoon, cities that have all suffered from two oil price crashes in a decade, but remained below prepandemic levels. In Atlantic Canada, starts more than doubled in Halifax, Saint John and Moncton. CMHC says they are still worried about downside risks, including a second wave of CV19 cases and another lockdown, high unemployment, no immigration and homeowners who are unable to resume mortgage payments when their six-month deferrals end. The agency has also forecast a decline in home prices of up to 18% from peak, but thus far that has not been the case. Canada’s home sales continued to rise in July, climbing 26% after jumping 63% in June and 56.9% in May and were up 30.5% from July 2019 on an unadjusted basis. The Canadian Real Estate Association (CREA) said that the 62,355 sales in July 2020 marked the highest monthly sales figure on records going back more than 40 years. The number of newly listed properties climbed 49.5% from May to June and available inventory was at a 3.6 months’ supply on a national basis, a 16-year low. Actual sales price was up 6.5% year over year. The benchmark five-year mortgage rate reported by the Bank of Canada fell to 4.79%, the third time mortgage rates have dropped this year. The Bank of Canada (BOC) noted the drop in rates will help make it easier for buyers to qualify for mortgages. The BoC dropped rates to 4.94% in May after dropping them to 5.04% in March. June Retail Sales Rise 23.7% Retail sales rose 23.7% in June to $53.0 billion. After three months of sales below pre-pandemic levels, retail sales in June were 1.3% higher than February sales as more regions moved ahead with plans to reopen their economies. Sales were up in every province and all subsectors, with growth primarily led by motor vehicle and parts dealers, as well as clothing and clothing accessories stores. Sales rebounded sharply at retailers that had been deemed non-essential at the start of the pandemic. Furniture and home furnishing stores (+70.9%), building material and garden equipment and supplies dealers (+13.0%), as well as sporting goods, hobby, book and music stores (+64.9%) all posted sales that were higher than February levels. Overall, second quarter retail sales were down 13.3% compared with the first quarter. In volume terms, quarterly retail sales were down 12.4%. Retail Ecommerce Sales Grow Retail ecommerce sales were $3.2 billion in June, accounting for 5.5% of total retail trade. Ecommerce sales in June made up a smaller share of retail sales than in April and May, as more non-essential retailers opened their brick-and-mortar stores. However, the proportion of ecommerce to total retail sales still remained above the pre-pandemic share in February. On a year-over-year basis, retail ecommerce increased 70.6%, while total unadjusted retail sales increased 3.0%. Retail Notes Canadian Tire’s Q2 revenues fell to $3.16 billion in June, down from $3.69 billion in June 2019. Performance was hurt by the temporary closure of many retail stores, including 203 of 504 Canadian Tire stores, in order to stop the spread of CV19. Retail sales excluding petroleum rose 9.3% for the quarter. Sales grew 20.3% at Canadian Tire stores, but sales dropped at SportChek and Mark’s. Shipments to Ontario dropped 26% during the five-week closure in that province. Lower orders were coupled with unprecedented and unpredictable demand for some products, including bicycles, pools and outdoor furniture, where demand far exceeded both historical demand and available inventory. Canadian Tire also incurred $41 million in additional costs related to the pandemic, including adding safety protocols to stores. Canadian Tire is using artificial intelligence (AI) to help manage through the economic disruption caused by the pandemic. Canadian Tire temporarily closed or operated in a limited capacity about 40% of stores. Last year CT debuted a platform that uses machine learning to analyze internal sales-related data and external environmental data in order to spot patterns, such as increases in particular items at individual stores. The system also uses natural language processing, so 4,500 front-line employees can interact with it through voice queries or texts. For example, the system picked up trends immediately that led to a 189% increase in demand for exercise equipment and a 110% growth for backyard items, including patio furniture and barbeque grills. When the system picked up a surge in bicycle sales in West Coast stores, the company was able to redeploy inventory almost immediately to meet demand and saw bicycle sales rise 78% compared to Q2 last year. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

Archives

July 2024

|