|

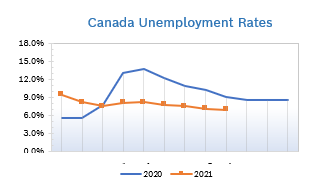

Unemployment Drops to 6.9%

Consumer Prices Rise 4.1% The Consumer Price Index (CPI) rose 4.1% on a year-over-year basis in August, the fastest pace since March 2003, up from a 3.7% gain in July. The increase in prices mainly stems from an accumulation of recent price pressures and from lower price levels in 2020. Excluding gasoline, the CPI rose 3.2% year over year. The monthly CPI rose 0.2% in August, down from a 0.6% increase in July. On a seasonally adjusted monthly basis, the CPI rose 0.4%. Prices rose in seven of the eight major components in August and in every province. Statistics Canada is attempting to balance the impact of the pandemic by removing items that were not available in March from the year-over-year comparisons. GDP Drops 0.1% Real GDP edged down 0.1% in July after expanding 0.7% in June. Total economic activity was 2.0% below February 2020's pre-pandemic level. Overall, 13 of 20 industrial sectors were up, led by strong growth in accommodations and food service as people traveled more and ate out. Retail trade fell 1.1% in July, with 7 of 12 subsectors posting declines. Food and beverage stores (-3.3%) and building material and garden equipment and supplies dealers (-6.5%) were the biggest factors in the decline. Construction contracted 0.9% in July. The third consecutive decline was largely due to a 2.7% drop in residential building construction. It was the third consecutive monthly decline after the category hit record-highs in April. Almost all types of residential construction activity were down, led by single-family homes and home alterations and improvements. Repair construction fell 1.6% while engineering and other construction activities rose 1.1%. Interest Rates Steady The Bank of Canada (BoC) held their target overnight interest rate at 0.25%, warning that the fourth wave of the pandemic and supply bottlenecks could weigh on the economic recovery. The news came after the economy contracted an annualized 1.1% in the second quarter. BoC also said they would raise interest rates before cutting their current program of buying bonds at a pace of $2 billion per week. However, they assured markets that the timing of any rate hike will depend on the pace of the economic recovery. The BoC is also studying the difficulties businesses are having hiring employees and planning to estimate the effects on the economy. The annual pace of inflation rose to 3.7% in July, the biggest increase since May 2011. Housing and Construction News Canada housing starts fell again in August, dropping to 283,971 units from 286,076 units in July, according to Canada Mortgage and Housing Corporation (CMHC). This trend measure is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR) of housing starts. Monthly housing starts fell 3.9% to 260,239 units in August. Home sales fell 0.5% in August after falling 3.5% in July, according to the Canadian Real Estate Association (CREA) and were down 14% from August 2020. CREA noted that five consecutive months of dropping sales is an indication of continuing fatigue and frustration among buyers dealing with sky-high prices and a shortage of homes. CREA said that home prices seem to be stabilizing at an unacceptably high level with very low inventory (2.2 months), continuing chronic shortages of building supplies and prices that are up an average of at least 20% year over year. Analysts caution that fixed mortgage rates could begin to rise as soon as this fall and variable-rate mortgages could rise next year because bond yields have begun rising to pre-pandemic levels. Home Sales Forecast The Canadian Real Estate Association (CREA) lowered their forecast for home sales for this year and now predicts there will be 656,300 homes sold in 2021, up 19% from 2020 but down 4% from initial forecasts. Sales fell more rapidly than expected in the spring, but immigration levels are rebounding and Canadian businesses closed during the pandemic are being allowed to reopen. CREA expects prices to rise 19.9% this year to an average of $680,000, up from initial forecasts of $678,000. CREA expects prices to rise 5.6% next year with the average price reaching $718,000 in 2022 and home sales falling by 12.1% to about 577,000 homes in 2022. Retail Sales Fall 0.6% Retail sales fell 0.6% in July to $55.8 billion after rising to $56.2 billion in June. Building material and garden sales dropped 7.3%, accounting for much of the decline. Much of the country continued to implement reopening measures in July which eased restrictions on both retailers and services. Sales decreased in 5 of 11 subsectors, representing 38.7% of retail trade. Core retail sales, which exclude gasoline stations and motor vehicle and parts dealers, decreased 1.3%. In volume terms, retail sales decreased 1.1% in July. Sales restrictions were eased in many regions and sales were up in six provinces and 8 of 11 subsectors, representing 69.5% of retail trade. Retail Ecommerce Sales Fall 19.5% On a seasonally adjusted basis, retail ecommerce sales fell 19.5% in July. On an unadjusted basis, retail ecommerce sales were down 2.9% year over year to $2.9 billion in July, accounting for 4.6% of retail trade. The share of ecommerce sales in total retail sales fell 1.6% in July from June as restrictions eased and people ventured out to shop in person. It was the lowest share for ecommerce sales since February 2020. Retail Notes Amazon plans to hire 15,000 employees across Canada and increase wages to between $17 and $21.65 per hour from current starting wages of about $17 per hour. Existing employees will also receive an hourly increase between $1.60 and $2.20. A spokesperson for Amazon Canada said they are growing very rapidly and they want to stay focused on their customers. Amazon Canada currently has 25,000 employees in 25 communities across five provinces as well as 46 warehouses, logistics and delivery facilities, up sharply from 2020. Amazon is offering a $100 bonus for showing proof of vaccination but is not currently requiring Canadian employees to be vaccinated. Lowe’s Canada is now offering same-day delivery in more than 140 Lowe’s, RONA and Reno-Depot corporate stores in major urban hubs in British Columbia, Alberta, Ontario and Quebec. Customers must order before 2:00 p.m. on weekdays and noon on Saturday. Canadian Tire is acquiring a 25% stake in Ashcroft Terminal Limited, a provider of intermodal and transloading services including container storage, material handling and logistics. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

Archives

July 2024

|