|

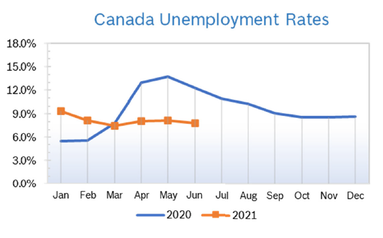

Unemployment Falls to 7.8%

Consumer Prices Rise 0.5% The Consumer Price Index (CPI) rose 0.5% in May after rising 0.5% in April and was up 3.6% year over year after being up 3.4% year over year in April, according to Statistics Canada. The annual increase was the highest since May 2011 and could raise concerns that price pressures could be stronger than anticipated by the Bank of Canada (BoC), eventually leading to an increase in interest rates. Prices rose in every major component on a year-over-year basis. Shelter prices rose 4.2% year over year in May, the largest yearly increase since September 2008. Gasoline prices continued to rise, but at a slower pace. The BoC had earlier projected that inflation would rise to about 3% because of the disparate comparisons to 2020, but should return to close to the bank’s target of 2% by the end of the year. Statistics Canada is attempting to balance the impact of the pandemic by removing items that were not available in March from the year-over-year comparisons. GDP Falls 0.3% in April Real GDP contracted 0.3% in April after 11 consecutive monthly increases. With the first decline in 12 months, total economic activity remained at about 1% below its level before the Pandemic began affecting economic activity in February 2020. Overall, 12 of 20 industrial sectors were down as gains in goods-producing industries (+0.5%) were more than offset by contractions in services-producing industries (-0.6%). Preliminary information indicates a 0.3% decrease in real GDP in May. The retail trade, construction and real estate rental and leasing sectors contributed the most to the declines. Retail trade retreated 5.5% in April, dampening the previous two monthly expansions, as 10 of 12 subsectors were down. The construction sector rose 2.4% in April, up for a fifth consecutive month, as all components increased. Residential building construction rose 4.1%, leading the expansion with a fifth consecutive monthly increase. Continued growth in single-family homes and multi-unit dwellings construction more than offset lower activity in home improvements and renovations. Repair construction increased 0.6%, while engineering and other construction activities grew 1.6%. Non-residential building construction rose 1.1%. Interest Rates Steady The BoC left its key interest rate on hold at 0.25% at their meeting in early June and reiterated their view that the recent jump in inflation is temporary and the country’s economic recovery is largely on track. With vaccinations proceeding at a faster pace and provincial containment restrictions easing over the summer the BoC expects the economy to rebound strongly. The benchmark interest rate has been at 0.25% for more than a year. Housing and Construction News Canadian housing starts rose 3.2% in May to 279.900 units after dropping 19% in April. The strong showing pushed the six-month average to just over 280,000 units, which analysts termed “very healthy.” The increase was led by multifamily starts; single-family starts fell 18% t an annualized rate of 64,000. Nationally, starts are down 11% in the second quarter to date compared to the first quarter, partially due to a big drop in Ontario. Home sales fell 7.4% in May after falling 12.5% in April, according to the Canadian Real Estate Association (CREA). CREA noted that two consecutive months of dropping sales is an indication of fatigue and frustration among buyers dealing with sky-high prices and a shortage of homes. In addition, the urgency to find a good place to hunker down during the pandemic is fading as the country begins to open up again. Vaccinations are increasing and many provinces are now reopening after a third round of shut downs. The national average selling price was C$696,000, down 1.1% from April but still up 38.4% from April 2020. Actual sales, not seasonally adjusted, were up 103.6% from May 2020, when lockdowns were in place. Retail Sales Fall 5.7% Retail sales fell 5.7% in April to $58 billion after rising to an upwardly revised number in March. Sales decreased in 9 of 11 subsectors, representing 74.2% of retail trade. Core retail sales, which exclude gasoline stations and motor vehicle and parts dealers, decreased 7.6%. In volume terms, retail sales decreased 5.6% in April. Retail sales fell primarily due to restrictions put back in place in response to a third wave of CV19 cases. Sales at building material and garden equipment and supplies dealers dropped 10.4%, the first decline in nine months. Despite the decline, sales remained above levels reached in February 2021. The drop in retail sales follows record sales of hardware, tools, renovation and lawn and garden products in March. Retail sales declined in seven provinces. Retail Ecommerce Sales Climb On a seasonally adjusted basis, retail ecommerce fell 0.4% in April. On an unadjusted basis, retail ecommerce sales were up 7.4% year over year to $4.0 billion in April, accounting for 7.0% of total retail trade. The share of ecommerce sales out of total retail sales rose 0.4% in April. Retail Notes Amazon Canada introduced My Wellbeing, a digital resource that will provide Amazon employees with a single point of access to a range of physical, mental, social and financial care providers. Amazon employees can use their mobile devices or computers to access exclusive virtual physiotherapy sessions, a virtual gym, mental health support and much more. Amazon plans to open a 600,000-square-foot robotics fulfilment center in Alberta in 2022. The center will be used to pick, pack and ship small items such as books, electronics and toys. The smart systems will support, not replace, employees; the new center will create more than 1,000 jobs. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

Archives

July 2024

|