|

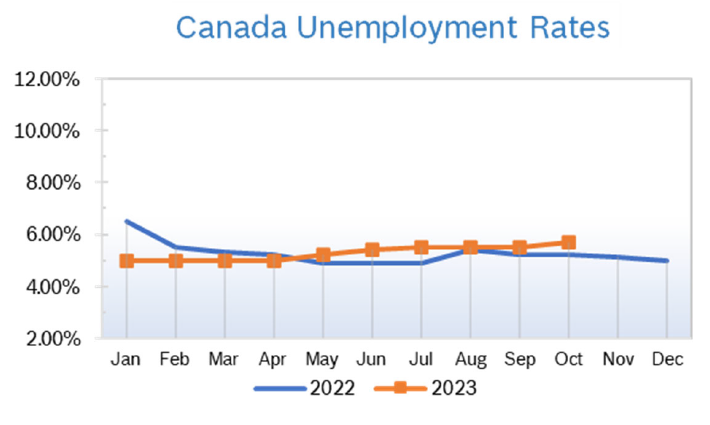

Unemployment Rises to 5.7%

Consumer Prices Rise 3.8% Consumer prices were up 3.8% year over year in September after being up 4.0% year over year in August. The unexpected decrease was driven by declining prices across the board, although housing costs continued to rise. Analysts say the mostly downward trend may give the BoC permission to take their foot off the gas instead of raising rates again. Housing and Construction News Canadian housing starts rose 8% in September after falling 1% in August. The unexpected jump was due to an increase in groundbreaking on multi-unit and single-family-detached projects. The seasonally adjusted annualized rate of housing starts rose to 270,466 units from a revised 250,383 units in August, according to the Canadian Mortgage and Housing Corporation (CMHC). Economists had expected starts to fall to 240,000. Canadian home sales fell 1.9% in September after dropping 4.1% in August but were up 1.9% from September 2022, according to the Canadian Real Estate Association (CREA). It was the third consecutive monthly decline for existing home sales. The national average home price was up 2.5% from September 2022 to $655,507. Inventory remains a challenge in Canada as demand continues to exceed supply, though new listings have now risen about 35% from the 20-year low reached in March. The sales-to-new listings ratio eased to 51.4% in September from 55.7% in August, the first time it has dipped below the long-term average of 55.2% since January. Mortgage borrowers have been under increasing stress with the 475-basis-point spike in interest rates over the past 18 months. Interest Rates Steady at 5% The Bank of Canada’s (BoC) held interest rates steady at 5% after their meeting in late October. The central bank stated that the economy was in a period of low growth, not a recession, although they also stated that inflationary risks have increased, and they were prepared to raise rates again in the future “if necessary.” The central bank also noted that they were not seeing the decline in home prices they’d expected, as generally when interest rates go up, home prices go down. They think a supply shortage and steady demand are combining to keep home prices elevated. The typical home price across the country fell as much as 17% after the Bank of Canada started raising interest rates last year. Home values started to rebound in February this year after the central bank said it would take a break from hiking rates. That break lasted four months, and home prices have started to fall again. The country’s typical home price was $741,400 in September, according to the Canadian Real Estate Association’s home price index. Retail Sales Fall 0.1% Retail sales fell 0.1% in August to $66.1 billion after rising to a downwardly revised number in July. Sales were down in six of nine subsectors and were led by a significant decrease at motor vehicle and parts dealers. Core retail sales, which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers, were down 0.3% in August. In volume terms, retail sales declined 0.7% in August. Retail sales fell in six provinces, with the biggest decline in British Columbia. Approximately 12% of Canadian retailers reported that their business had been affected by the strike at the ports in British Columbia. Retail sales dropped 22.1% in the Northwest Territories in August, coinciding with wildfire evacuations. Advance indicators point to retail sales being unchanged in September as analysts point to the economy being “sluggish.” Retail Ecommerce Sales Fall 2.0% Retail ecommerce sales were down 2.0% to $3.9 billion in August, accounting for 5.8% of total retail trade, compared with 6.0% in July. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

Archives

July 2024

|