|

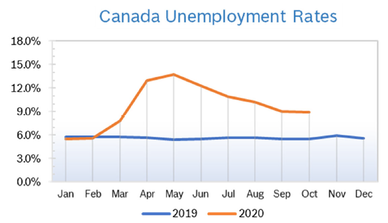

Unemployment Drops to 8.9%

Consumer Confidence Drops to 74.1 The Index of Consumer Confidence fell 9.5 points in October to 74.1 after rising to 83.6 in September, according to the Conference Board of Canada. Consumer confidence deteriorated in October as restrictions tightened amid the second wave of CV19. It was the largest monthly drop for the index since April. Concerns over future job prospects were the main drivers of the plunge. Compared with its peak, reached in February (120.6), the index is now 46.5 points below its pre-pandemic level. The monthly Index of Consumer Confidence is constructed from responses to four attitudinal questions posed to a random sample of Canadian households. Consumer Prices Rise 0.5% The Consumer Price Index (CPI) rose 0.5% on a year-over-year basis in September after rising 0.1% in August. Economists had expected prices to increase 0.4% Excluding gasoline, the consumer price index rose 1.0% in September after rising 0.6% in August. On a seasonally adjusted monthly basis the CPI rose 0.1% in September. Prices rose year over year for six of the eight major components but did not follow typical seasonal patterns, which have been affected by CV19. Regionally, prices rose in seven provinces. Despite the increase, economists expect inflation to remain below the Bank of Canada’s (BoC’s) target of 2%. Economists noted that despite the rebound, prices have a long way to go to recover. For the year, the Conference Board now expects consumer prices to rise just 1.1%. GDP Grows 1.2% in August GDP grew 1.2% in August after growing 3.1% in July, according to Statistics Canada. Growth was ahead of economic forecasts. The fourth consecutive monthly gain left the Canadian economy just 5% below February’s pre-pandemic level. Both goods-producing (+0.5%) and services-producing (+1.5%) industries were up; 15 of 20 industrial sectors posted increases and two were essentially unchanged in August. The construction sector rose 1.5% in August, up for the fourth consecutive month, as the majority of subsectors increased, bringing sector activity to within 2% of February's pre-pandemic level. Residential construction grew 1.8% in August, surpassing the pre-pandemic level of activity as all types of residential construction were up. Both engineering and other construction (+2.7%) and repair construction (+1.5%) also grew, while non-residential construction contracted 1.7% with all components down. Both wholesale trade and retail trade rose by 0.4% in August, and were slightly above the pre-pandemic levels of activity, as subsectors in each of the sectors were evenly split between increases and decreases. Statistics Canada expects growth to slow in September, with the economy growing just 0.7%. Interest Rates Hold Steady After holding rates at 0.25% in October, the Bank of Canada (BoC) acknowledged that the pandemic will most likely have a “more-pronounced” near term impact on the recovery. The central bank pledged not to raise rates until inflation is sustainably at 2% and is shifting its major asset purchase program towards longer-term bonds, which have more direct influence on the borrowing rates that are most important for households and businesses. Analysts noted that the BoC has not achieved its inflation target in 10 years. Lower rates help drive down rates of mortgages and loans and make it easier for people to borrow and spend, which aids the recovery. Housing and Construction News The annual pace of housing starts dropped 20% in September to a seasonally adjusted annual rate of 208,980 units, well below expectations of 240,000 starts. The decrease was driven by weakness in Ontario and British Columbia and lower starts in condos. The six-month moving average rose slightly in September. Canada Mortgage and Housing Corp. (CMHC) expects starts to trend lower by the end of the year as a result of the negative impact of CV19 on economic and housing indicators. Moving forward, they expect housing starts to remain elevated through next year, as issuance of permits has remained strong and mortgage rates are low. Canada’s home sales continued to climb in September, rising 0.9% on a seasonally adjusted basis and up 45.6% compared to September 2019. It was the fifth consecutive month home sales have risen. Sales were up were up 1.7% from July and 9.4% from August 2019. The Canadian Real Estate Association (CREA) noted it was the third consecutive month that home resales and the price index have both hit record highs. The national average home price rose 17.5% to a record $604,000 in September. Excluding sales in the pricey Greater Vancouver and Greater Toronto areas, the national average price was about $479,000. Low Rates Motivate Young Buyers Younger Canadians say the pandemic has accelerated their plans to purchase a home or investment property, although about one-third of respondents said they were waiting for prices to drop before buying a home, according to the Scotiabank 2020 Housing Poll. More Albertans (39%) than other Canadians (25%) believe that prices will come down over the next 12 months. Members of the key home-buying segment aged 25 to 34 are the most optimistic, with 36% of respondents believing prices will fall. Overall, 38% of Canadians believe now is a good time to buy. More than 70% of renters say they have no plans to buy a new home in the next year or two, despite low interest rates. In addition, 26% of respondents are seriously considering a renovation to their current home, a response that was attributed to the fact that during the pandemic more people are spending much more time at home. Retail Sales Rise 0.4% Retail sales rose 0.4% in August to $53.2 billion after rising to $52.9 billion in July. It was the slowest pace of increase since the economy began recovering, and most likely a sign that pent-up demand has been largely satisfied. While it was the fourth consecutive monthly increase in retail sales, it fell short of the 1.1% gain forecast by Statistics Canada. Nevertheless, total sales in August were 1.8% higher than pre-pandemic sales in February and 3.5% ahead of August 2019. Sales at building material and garden supply stores rose 4.5%, a sign that Canadians are still investing in home renovations. Recovery has been very challenging for some sectors, especially apparel; with more people working out of home offices and children going to virtual school there is less need for attire. One economist noted that while sales surprised to the downside, consumers might be reallocating budgets towards services, including restaurants dining and bars. Note: Canadian retail sales do no include spending on food services. Retail Ecommerce Sales Retail ecommerce sales rose 60.6% year over year, accounting for 5.0% of total retail trade. When adjusted for basic seasonal effects, retail ecommerce was down 2.0% in August. The share of ecommerce sales as a percentage of total retail sales edged up from July despite more retailers expanding in-person shopping in accordance with public health measures. The share of retail ecommerce sales as a portion of total retail trade in August was up 1.8% year over year. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

Archives

July 2024

|