|

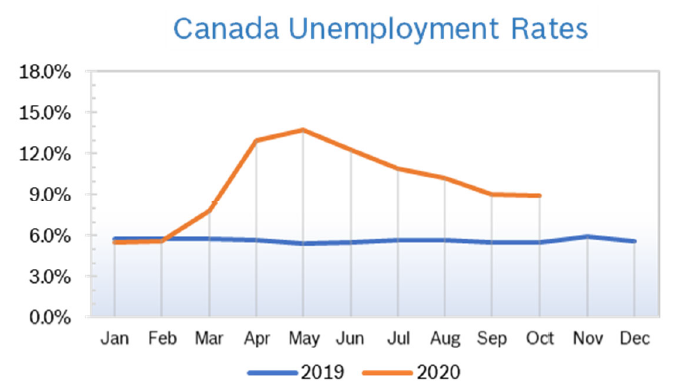

Consumer Confidence Falls to 47.6 The Index of Consumer Confidence fell 41 points in April to 47.6 after dropping 32 points in March to 89, according to the Conference Board of Canada. It was the lowest level of confidence on record. The Conference Board stated that the sharp back-to-back declines were due to anxiety about the future and the realities of adjusting to social distancing and other impacts of the CV19 pandemic. Thousands of Canadians have lost their jobs, and the outlook for the next six months is bleak. Nationally, 36.1% of Canadians expect their financial situation to worsen over the next six months. The monthly Index of Consumer Confidence is constructed from responses to four attitudinal questions posed to a random sample of Canadian households. Consumer Prices Drop 0.9% The Consumer Price Index (CPI) dropped 0.9% in March after rising 2.2% in February, according to Statistics Canada. Year-over-year inflation dropped to 0.9% in March from 2.2% in February, the sharpest slowdown since September 2006. Excluding food and energy, consumer prices rose 1.7% year over year in March and were up 0.1% on a monthly basis. Energy prices fell 11.6%, driven by the biggest one-month price decline since November 2008. Gasoline prices sank 21.2%, while prices of services rose 2.0%. For the year, the Conference Board now expects consumer prices to rise just 1.1%. Unemployment Rises to 13.0%

March GDP Falls 9.0% The Canadian economy had its worst month on record in March as GDP shrank 9.0%, according to what was called an “unprecedented flash estimate” published by Statistics Canada in mid-April. The plunge was brought on by the combination of an economic shutdown and historically low oil prices. The March plunge dragged Q1 GDP down to –2.6%. Both the monthly and the quarterly readings were significantly below expectations. Some analysts expect GDP to decline by as much as 32% in the second quarter. While every province has fallen into recession, the Conference Board of Canada expects Alberta to fare the worst, due to low oil prices. Statistics Canada noted that some sectors, including food distribution, health, and online retailing and streaming, demonstrated their potential for growth. Conference Board Trims Outlook The Conference Board revised economic projections for the year in light of the continually changing impact of both coronavirus and the global oil wars. They now expect real GDP to contract 4.0% this year, down from 0.3% growth projected in March. They now expect GDP to grow an upwardly revised 4.9% in 2021 as the impact of CV19 hopefully fades. Both consumer and business spending have dropped dramatically. The federal government is virtually the only sector where spending is growing. A combination of tumbling global demand and the decision by Saudi Arabia and Russia to gain market share by ramping up production dragged oil prices down to the $20 per barrel range. While the major oil-producing countries recently reached an agreement on production cuts, oil prices have remained unnaturally low because of the sharp plunge in demand from every corner of the world economy. Bank of Canada Holds Rates The Bank of Canada held key overnight interest rates at 0.25% in mid-April after cutting rates by 0.50% at the end of March. BoC announced a new provincial bond purchase program of up to C$50 billion to supplement their money market purchase program and is temporarily increasing the amount of Treasury Bills they acquire at auctions to as much as 40%. Banks Cut Credit Card and Loan Rates Several Canadian banks lowered interest rates on their credit cards for those in financial hardship due to the pandemic. Vancity, Canada’s largest community credit union, temporarily cut credit card interest rates to zero and is deferring minimum payments for those facing financial difficulties due to CV19. Canada’s six largest lenders have announced major relief programs, including payment deferrals on mortgages and other loans and interest-free loans for small business. At the beginning of April, banks had granted or begun processing nearly 500,000 requests to defer or skip mortgage payments, which amounts to more than 10% of the mortgages they hold. Mortgage Applications Continue to Rise The number of mortgage refinancing applications has skyrocketed since the Bank of Canada’s (BoC) most recent rate cut, which brought the key interest rate down to just 0.25%. The record-low rates prompted many Canadians to refinance their mortgages, with applications going up 389% from February to March 2020, according to LowestRates.ca mortgage quoter. Mortgage applications doubled over the same time frame. Housing and Construction News The six-month trend for housing starts fell in March to a seasonally adjusted annual rate of 204,717 units compared to 209,109 units in February, according to Canada Mortgage and Housing Corporation (CMHC). Despite the overall decline, starts were up in Vancouver, Alberta and Manitoba. The standalone monthly measure of housing starts for all areas in Canada was 195,174 units in March, a decrease of 7.3% from 210,574 units in February. Single-detached urban starts increased by 8.8% to 58,480 units. Rural starts were estimated at a seasonally adjusted annual rate of 12,621 units. Canada’s home sales fell 14.3% in March compared to February, on a seasonally adjusted basis. Restrictions on physical distancing and the closure of non-essential businesses began in the middle of March as part of the effort to stop the spread of CV19, according to the Canadian Real Estate Association (CREA). Home sales for March were up 7.8% compared to a slow March in 2019, but CREA noted that figure was in sharp contrast to year-over-year gains of close to 30% in February. The national average price for a home sold in March was just over $540,000, up 12.5% from a year ago. Excluding pricey Greater Vancouver and Toronto, the average price was about $410,000. Mortgage rates fell amid a sharp drop in bond yields with 5-year rates dropping to 4.99% from 5.34% and special rates, which are actually closer to what most buyers pay, falling to 3.1% from 3.2%. There is a lot of pressure on banks to cut rates even more based on current market conditions and sluggish growth prospects. Home Sales Could Fall 30% Canada could see sales of existing homes plunge 30% and home prices drop for the first time since 2009, according to the Royal Bank of Canada (RBC), with CV19 ending a spring season that got off to a roaring start. Real estate and residential building construction accounted for almost 15% of Canada’s output last year. The value of real estate assets owned by households has risen by $2.5 trillion over the past decade, an increase of 80% from the previous decade. However, industry experts expect the market to rebound quickly once the virus is under control. They believe the pandemic will be a tough but temporary blow to Canada’s housing market, with resales jumping more than 40% next year on low interest rates, strengthening job markets and bounce-back immigration. However, they note a deeper recession could dampen prospects, and say that some of that depends on what happens in the US, “the elephant south of the border.” February Retail Sales Rise 0.4% Retail sales rose 0.3% to $52.2 billion in February. This marked the first time retail sales increased for four consecutive months since the period ending in October 2018. Higher sales at motor vehicle and parts dealers and general merchandise stores were partially offset by lower sales at food and beverage stores. Sales were up in 6 of 11 subsectors, representing 62.5% of retail trade. Retail sales in volume terms increased 0.2%. Approximately 25% of Canadian retailers reported that their business in February had been affected by the rail blockades and/or COVID-19. While a number of retailers reported impacts on their business activities, less than 0.5% of Canadian retailers were shut down for any period of time in February. Some retailers reported positive impact. Retail sales rose in five provinces, but declined in Alberta and Quebec. On an unadjusted basis, retail ecommerce sales were $1.6 billion in February, accounting for 3.6% of total retail trade. On a year-over-year basis, retail ecommerce increased 17.8%, while total unadjusted retail sales rose 7.0%. March numbers will be substantially different, with overall retail sales falling. However, grocery sales rose a historic 38% in March and Canadian retailers opened or expanded ecommerce platforms in response to social distancing measures and physical store closures. Retail Notes Canadian Tire Corporation launched a $5 million CV19 Response Fund to help Canadians and communities respond to the current pandemic. The fund is comprised of two donations of $1 million each to the Canadian Red Cross and United Way Centraide Canada, as well as up to $3 million in personal protective equipment (PPE) and essential products from across the Canadian Tire family of companies that will be used to support frontline medical workers and community organizations in need. In addition, Canadian Tire Associate Dealers independently donated 160,000 masks, 164,000 pairs of gloves and 20,000 litres of hand sanitizer to local hospitals, nursing homes and community organizations. They also stopped replenishing N95 masks in their stores and online and donated remaining supplies to frontline healthcare workers. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

Archives

July 2024

|