|

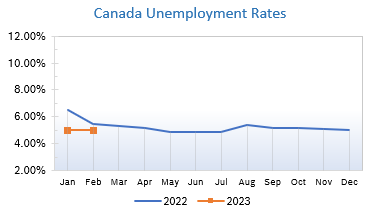

Unemployment Steady at 5.0%

Consumer Prices Consumer prices were up 6.3% year over year in December after being up 5.4% in November. Falling gasoline prices and another drop in the homeowner’s replacement cost (HRC) index contributed to the decline. The HRC index has decelerated, on a year-over-year basis, every month since May 2022 when it rose 11.1%. On a monthly basis, the CPI fell 0.6% in December after rising 0.1% in November. On a seasonally adjusted monthly basis, the CPI was down 0.1%. Bank of Canada The BoC contemplated not raising rates at all in late January, according to a transcript of the discussion that surrounded the 0.25% increase that was announced. While the US Fed generally releases transcripts and remarks, the BoC seldom does, so the information was closely scrutinized. They decided to go ahead and raise rates because of the strong state of the economy in real time and worries that inflation might get “stuck” where it was instead of dropping into the 2% range both the BoC and the US Fed target. Rates are currently at 4.50%, the highest level in fifteen years. Housing and Construction News Housing starts fell 13% in January, dropping to 215,365 units from a downwardly revised 248,296 units in December, according to Canada Mortgage and Housing Corp. (CMHC). Single-family starts rose 3% to 45,224 after falling in December. Canadian home sales fell 3% in January to a 14-year low after rising 1.3% in December, and were down 37.1% from January 2022, according to the Canadian Real Estate Association (CREA). Home prices fell 1.9% in January to $714,700, excluding high-priced metros. The home price index is down 12.6% from January 2022 and is 15% below last February's peak values. More homeowners put their properties on the market, with new listings increasing 3.3% in January. For the longer range, CREA forecasts that national home sales will rise slightly more than 10% in 2024, though that would still be below 2020 and 2021 figures, while the average home price is expected to recover 3.5% from 2023 prices. Retail Sales Retail sales increased 0.5% to $62.1 billion in December. Sales increased in 7 of 11 subsectors, representing 75.1% of retail trade. Higher sales at motor vehicle and parts dealers (+3.8%) and general merchandise stores (+1.7%) led the increase. Core retail sales, which exclude gasoline stations and motor vehicle and parts dealers, increased 0.4%. In volume terms, retail sales increased 1.3% in December. Sales increased in four provinces but fell in British Columbia. Retail sales increased 8.2% in 2022, led by gasoline stations and general merchandise stores. In volume terms, sales were up 1.5% in 2022. Sales at building material and garden equipment and supplies dealers fell 3.8%, the largest decline to core retail sales. Sales declined for four consecutive months amidst higher interest rates and deteriorating housing market conditions. Retail Ecommerce Sales Retail ecommerce sales were down 5.7% in December on a seasonally adjusted basis after being down 2.7% in November. On an unadjusted basis, retail ecommerce sales were down 2.4% year over year to $4.4 billion in December, accounting for 6.5% of total retail trade. The share of ecommerce sales out of total retail sales fell 0.6% compared to December 2021. Retail Notes Canadian Tire’s consolidated retail sales were up 1.2% compared to the fourth quarter of 2021, and up 17.6% on a three-year stacked basis. Consolidated comparable sales were in line with 2021's exceptional performance, and up 21.1% on a three-year stacked basis. Annual and quarterly sales and earnings beat expectations. GDP GDP edged up 0.3% in the fourth quarter of 2022, following five consecutive quarterly increases. Slower inventory accumulations along with declines in business investment in machinery and equipment and housing offset higher household and government spending and improved net trade. On an annual basis, real GDP and final domestic demand rose for the second consecutive year, following the COVID-19 pandemic-induced contraction in 2020. Housing investment fell 2.3% in the fourth quarter of 2022, the third consecutive quarterly decrease. The decline was widespread across new construction (-1.4%), renovations (-2.6%), and ownership transfer costs (-4.0%). This coincided with higher borrowing costs. Household spending rose 0.5% in the fourth quarter, after edging down 0.1% in the third quarter. Overall, household spending rose 4.8% in 2022. Service expenditures (+8.6%) led growth as consumers took advantage of the relaxation of lockdown restrictions in the first half of the year. Semi-durable goods grew a robust robustly 6.6%; growth was moderated by a 2.0% decline in durable goods. Consumer Prices Rise 5.9% The consumer price index (CPI) rose 5.9% year over year in January following an increase of 6.3% in December. On a monthly basis, the CPI rose 0.5% in January after falling 0.6% in December. Core prices ex food and energy cooled off again, rising 4.9% year over year after being up 5.3% in December. Core inflation remained well above the Bank of Canada’s (BoC) target of 2% but is down significantly from 8.1% in June. Shelter prices increased at a slower rate, rising 6.6% year over year in January after a 7.0% increase in December. Growth in other owned accommodation expenses (+1.1%) and homeowners' replacement cost (+4.3%) continued to decelerate as the housing market cooled off. The mortgage interest cost index rose 21.2% year over year as interest rates continue to climb. It was the largest increase since September 1982 and followed an 18.0% increase in December. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

Archives

July 2024

|