|

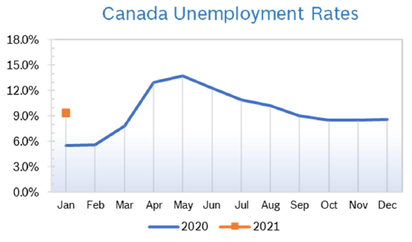

Unemployment Rises to 9.4% in January

Consumer Prices The Consumer Price Index (CPI) rose 1% year over year in January after rising just 0.7% in December, the slowest pace since 2009. The acceleration in consumer prices was largely due to a 1.7% increase in prices for durable goods and a 6.1% jump in gasoline prices compared with December 2020. Excluding gasoline, the CPI grew 1.3% in January, up from a 1.0% increase in December. On a seasonally adjusted monthly basis, the CPI rose 0.4% in January. Prices were up in most provinces. GDP Rises 0.1% in December GDP grew 0.1% in December after growing 0.7% in November, the eighth consecutive monthly gain. GDP remained 3% below pre-pandemic levels in February 2020. Goods-producing industries were up 0.6% and services-producing industries fell 0.1%. Sales in the retail trade sector fell 3.3% in December after seven consecutive months of growth, as 10 of 12 subsectors were down. December saw the reintroduction of lockdown measures across many parts the country including the closure of all non-essential retailing and strict capacity and physical distancing control at essential retailers. Construction rose 1.2% in December, following a 0.3% contraction in November, as the majority of subsectors increased. Residential construction grew 1.4% in December, and repair construction increased 1.5%. Housing and Construction News The six-month moving average of housing starts rose to 244,963 in January from 238,747 in December, with both single-and multifamily starts rebounding strongly after declining in December. Single-family starts were particularly strong in Montreal, reaching their highest level since 2008. The standalone monthly seasonally adjusted average rate of housing for all of Canada was 281,389 units in January, up 22.7% from December. Canada Mortgage and Housing Corporation (CMHC) expects housing starts to remain elevated this year, as issuance of permits has remained strong and mortgage rates are low. Home sales continued to rise in January, up 35.2% compared to January 2020, according the Canadian Real Estate Association (CREA). Sales for December were up 2% compared to December 2019. The actual national average home price was a record $621,525 in January, up from $607,280 in December and up 22.8% from January 2020. CREA said that excluding the Greater Vancouver and Greater Toronto areas, two of the most active and expensive markets, lowers the national average price by almost $130,000. However, year-over-year price increases between 25% and 30% were seen in many parts of Ontario as well. Inventory remains at historic lows with more than 90% of listings selling in less than a month. Year-over-year prices are up in double-digits for most areas. Mortgage rates are expected to remain low. Retail Sales Retail sales dropped 3.4% in December to $53.4 billion, posting their largest decline since the April low driven by the pandemic. Sales were down in 9 out of 11 subsectors, representing 83.6% of retail sales. Core retail sales, which exclude sales by gasoline stations and motor vehicle and parts dealers, also posted their slowest growth since April, falling 4.6% in December on lower sales at general merchandise stores and clothing and clothing accessories stores, as well as sporting goods, hobby, book and music stores. In volume terms, retail sales fell 3.6% in December. On a quarterly basis, retail sales were up 1.2% in the fourth quarter compared with the third quarter of 2020, while retail sales in volume terms increased 0.8%. With the resurgence of CV19 cases in Canada, provincial governments began to reintroduce physical distancing measures, which directly affected the retail sector. Sales decreased in every province in December for the first time since April 2020, led by Ontario, British Columbia and Manitoba. Retail Ecommerce Sales Soar On an unadjusted basis, retail ecommerce sales rose 69.3% year over year in December to a record-high $4.7 billion. Ecommerce accounted for 7.8% of total retail trade in December, the largest share since May. The rise in ecommerce sales coincided with an uptick in the number of retailers reporting shutdowns in December. When adjusted for basic seasonal effects, retail ecommerce sales increased 1.1%. According to Emarketer, retail ecommerce gained a greater share of total retail last year, growing 20.7% to CA $39.22 billion, equal to 8.1% of retail. Consumer habits changed dramatically in 2020, and the move to online shopping will most likely boost ecommerce for years to come. Emarketer expects retail ecommerce will grow an additional 12.5% in Canada in 2021. Retail Notes Canadian Tire Q4 revenues at Canadian Tire stores grew 12.8%. Overall retail revenue rose 15% to $4.58 billion. Demand for home-related products has boomed since the onset of the pandemic last year. Ecommerce sales more than doubled, thanks to the pandemic-fueled boom in online shopping. For the full year, ecommerce sales rose 183% to $1.6 billion. Canadian Tire had $138 million in CV19-related costs over the past fiscal, not including the effects of store closings on revenue. Lowe’s and Rona stores are looking to hire thousands of part-time and full-time associates in Canada in preparation for the busy spring season. Amazon has invested $3 million in Canadian computer science programs in an effort to decrease the impending skills gap and meet the growing demands of ecommerce. StackCommerce estimates there will be 147,000 code-related jobs by 2022. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

Archives

July 2024

|