|

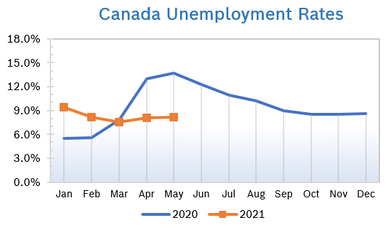

Unemployment Rises to 8.2%

Consumer Prices Rise 0.5% The Consumer Price Index (CPI) rose 0.5% in April and was up 3.4% year over year after being up 2.2% year over year in March, according to Statistics Canada. The annual increase was the highest since May 2011 and could raise concerns that price pressures could be stronger than anticipated by the Bank of Canada (BoC), eventually leading to an increase in interest rates. Core inflation, which reflects underlying price pressures, rose to 2.1% in April from 1.9% in March, the highest reading since 2012. Higher gasoline prices were responsible for much of the increase; prices were up 62.5% in April compared to April 2020 during the early weeks of the pandemic. The BoC had predicted inflation would rise to about 3% because of the disparate comparisons to 2020 but should return to close to the bank’s target of 2% by the end of the year. Statistics Canada is attempting to balance the impact of the pandemic by removing items that were not available in March from the year-over-year comparisons. GDP GDP grew 1.4% in the first quarter of 2021, following increases of 9.1% in the third quarter and 2.2% in the fourth quarter of 2020. These gains more than offset the sharp -11.3% drop in the second quarter of 2020. Real GDP was up 0.3% compared with the first quarter of 2020. Housing led the recovery, rising 26.5% compared to the first quarter of 2020. On a real basis, housing investment rose 9.4%, after increasing 29.6% in the third quarter and rising 4.0% in the fourth quarter of 2020. Growth in housing was attributable to an improved job market, higher compensation of employees, and low mortgage rates. After adding $63.6 billion of residential mortgage debt in the last half of 2020, households added $29.6 billion more in the first quarter of 2021. On a real basis, household spending increased 0.7% in the first quarter. Spending was down 1.9% compared with the first quarter of 2020. The savings rate rose from 11.9% in the fourth quarter of 2020 to 13.1% in the first quarter of 2021, more than double the rate of 5.1% in the first quarter of 2020. It was the fourth consecutive quarter the savings rate has been in double-digits. Interest Rates Steady The BoC is reportedly not in any hurry to raise interest rates, stating that Canada is still down 500,000 jobs from pre-pandemic employment levels and about 700,000 jobs from where the economy would ideally be with full employment. The Canadian dollar is up 4.5% so far this year and is the best performing major currency. The BoC now thinks inflation will move back into the 2% range sometime next year and they will probably raise rates during the second half of 2022. Interest rates have been at 0.25% for nearly a year; the bank cut rates three times in March 2020 as the pandemic began in order to keep credit flowing and ease costs for households. They also raised their forecast significantly for GDP growth this year to 6.5%. Housing and Construction News Canadian housing starts dropped 19% in April to 268,631 units from 334,759 units in March. Single-detached urban starts slipped 0.1% 78,918 after rising 3.6% in March. Analysts said much of the decline was due to a slowdown in the pace of multiple-unit projects. Home sales fell 12.5% in April after rising to record highs in March, according to the Canadian Real Estate Association (CREA). Sales declined to 60,987 homes and nearly 85% of all local markets, including B.C. and Ontario, saw sales decline. Inventory fell to just 1.7 months at the end of March, the lowest level on record. Listings were up more than 50% from last March to 105,001 and were up 7.5% on a seasonally adjusted month-over-month basis. The national average home price in March rose 2.4% to $723,500, up 23% from April 2020 and 56.7% from five years ago. Calgary and Montreal were the only two major urban markets that saw sales rise in April. Mortgage rates are expected to remain low. Rising Home Prices, Moderating Sales Home prices could rise by as much as 14% this year, but the pace of sales could moderate by the end of 2023 if broad immunity to CV19 is achieved soon, according to Canada Mortgage and Housing Corp. (CMHC). Prices across the country could soar to an average of $649,400 by the end of this year and peak at $704,900 in 2023 before beginning to moderate. CMHC predicts average prices will be between $584,000 and $602,300 this year but will slow to between $539,600 and $561,100 in 2023. CMHC says the pandemic-related surge in demand for lower-density homes in suburban and smaller communities will have run its course and rising mortgage rates and high prices will restrain demand. If the shift to working remotely proves to be permanent it could erode or even reverse price differentials between major metropolitan centers and rural locations. In the Greater Toronto area, where market conditions have really heated up during the pandemic, CMHC’s highest estimates show average prices rising to $1,087,600 this year and $1,205,400 by the end of 2023. Retail Sales Rise 3.6% Retail sales rose 3.6% in March to $57.6 billion after rising in February. Sales rose in 10 of 11 subsectors, representing 79.1% of retail sales. Core retail sales, which exclude sales at gasoline stations, and motor vehicle and parts dealers, rose 4.7% in March, buoyed by a 19.8% increase in building material and garden equipment and supplies sales. Core retail sales rose 3.8% in February. Core retail sales were up in most subsectors. Retail sales were up 1.8% in the first quarter, the third consecutive quarterly increase. In volume terms, quarterly sales were up 0.5%. Overall retail sales rose in six provinces, with Ontario leading the gains with a 9.0% increase. Retail Ecommerce Sales Climb On an unadjusted basis, retail ecommerce sales were up 58.5% year over year to $3.7 billion in March, accounting for 6.3% of total retail trade. The share of ecommerce sales out of total retail sales fell 0.7 percentage points in March as more brick-and-mortar stores were allowed to open their doors to in-person shopping. On a seasonally adjusted basis, retail ecommerce fell 1.5% in March. Retail Notes Lowe’s Canada plans to equip RONA and Reno-Depot corporate stores in Quebec with pickup lockers for contactless pick up of online orders. The lockers will be installed near the entrances of select stores and equipped with Bluetooth technology, a touchscreen and user-friendly access instructions. Customers will be able to retrieve products they bought online within seven days of the purchase by scanning a barcode found in their order confirmation email. By the end of spring, 104 stores will offer this option. Lowe’s plans to add more stores after the initial rollout. Lowe’s Canada operates some 470 corporate and affiliated stores under different banners in Canada. Canadian Tire revenue rose to $3.32 billion in the first quarter, up $2.85 billion from Q1 2020, and comp sales rose 19.3%. Only 40% of Canadian Tire stores were open at the beginning of 2021. CEO Greg Hicks credited the big bump to an early spring in much of the country and their ability to keep up with demand for outdoor gear, automotive products and home improvement items. Canadian Tire ecommerce sales jumped 257% in the first quarter to $450 million, and online sales for Canadian Tire quintupled compared to first quarter last year. Three-quarters of online orders are picked up curbside at a store. Canadian Tire will soon begin testing a subscription membership program, charging customers a flat fee for perks such as extra loyalty rewards for in-store purchases, free home delivery of all online orders and access to Bell Media’ Crave streaming service. The cost of this new program has not been decided. Amazon is postponing Prime Day in Canada due to the increasing impact of CV19 and the importance of protecting the health and safety of employees and customers. Cases have risen in Canada in recent months and less than 3% of the population is fully vaccinated. Amazon is adding new fulfilment centers in Langley, Mitt Meadows, Delta and Vancouver, British Columbia, that are expected to create 2,000 jobs. One center in Vancouver will be a 450,000 square foot robotics fulfillment center at the Port of Vancouver that will launch in late 2021 and employ 1,000 people in addition to the robots. It will be Amazon’s first robotics fulfillment center in B.C. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

Archives

July 2024

|