|

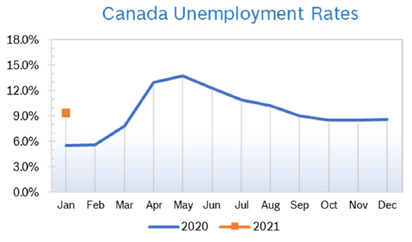

Unemployment Rises to 13.7%

Consumer Confidence Rises to 63.7 The Index of Consumer Confidence rose 16.2 points in May to 63.7 after plunging 41 points in April, according to the Conference Board of Canada. Consumers in all regions of Canada felt more confident in May than they did in April, but the index is still down more than 60 points from February. Thousands of Canadians have lost their jobs, and there are still worries about the oil crisis and large swings in prices. The monthly Index of Consumer Confidence is constructed from responses to four attitudinal questions posed to a random sample of Canadian households. Consumer Prices Drop 0.2% The Consumer Price Index (CPI) dropped 0.7% in April after falling 0.9% in March, according to Statistics Canada. Year-over-year inflation dropped to 0.2% in April after rising 0.9% year over year in March; the last time consumer prices fell year over year was September 2009. Excluding food and energy, consumer prices increased 1.5% in April after increasing 1.8% in March. Gas prices dropped 39.3% on a 12-month basis in April but have since rallied. However, gasoline prices are expected to remain a drag on Canada’s annual inflation rate. For the year, the Conference Board now expects consumer prices to rise just 1.1%. Q1 GDP Falls 2.1% Real GDP fell 2.1% in the first quarter and 8.2% on an annualized basis, due to reduced household spending and the widespread shutdown of businesses in March due to CV19. Household spending was down 2.3%, the steepest quarterly drop on record. Businesses drew down inventories and both exports and imports fell. Construction was down 4.4%, eclipsing the 3.3% contraction in January 2009. All subsectors declined, with residential construction (-3.8%), repair (-7.6%), and engineering and other construction (-3.2%) contributing the most. Technical and operational delays were encountered in the production of source data on building construction investment so first quarter results were estimated using proxy indicators of labour and material costs, as well as data from the Canada Mortgage and Housing Corporation. Spending on durables fell sharply but spending on non-durable goods rose 3.1% as people stocked up on food, beverages and cleaning supplies. Retail trade dropped 9.6%, the largest monthly decline since the series began in 1961, as 7 of the 12 subsectors were down. Motor vehicle and parts dealers contracted 38.6%, contributing the most to the decline. Excluding motor vehicle and parts dealers, retail trade would have shrunk by 3.2%. Sales also rose 7.2% at non-store retailers, where panic-buying and self-isolation preparations by consumers, along with a shift to online shopping to maintain physical distancing, greatly contributed to gains. Interest Rates and Economic Outlook Bank of Canada (BoC) says interest rates will probably stay low, and Canada is still on track to meet the best-case scenario for recovery released by the central bank in April. That forecast had growth shrinking 15% in the second quarter compared to the fourth quarter of 2019. Canada’s overall inflation rate turned negative in April. If there is a second wave of CV19, it could trigger a worst-case scenario. Housing and Construction News The six-month trend for housing starts fell 12% in April to a seasonally adjusted annual rate of 199,589 units from 204,899 units in March, according to Canada Mortgage and Housing Corporation (CMHC). Statistics were complicated by the fact that Quebec halted most construction until April 20, and CHMC did not collect any data from Quebec in April. They resumed in May. Meanwhile, the level of activity across the rest of Canada was fairly solid, and excluding Quebec, housing starts rose, on average, across the rest of the country. Canada’s home sales plunged 57.6% in April to 20,630 sales as both home buyers and sellers stayed home, according to the Canadian Real Estate Association (CREA). The levels of activity were the lowest since 1984, and almost double analysts’ projections. However, sales began to pick up in May as virtual viewing tools and the realization that there will be no quick end to the pandemic have helped people adapt to the new reality. The composite benchmark price was down 0.6% in April but was still up 6.4% from April 2019. The national average price for homes sold in April fell 1.3% from April 2019 to $488,000. Excluding the high-priced Toronto and Vancouver markets, average price was less than $392,000. Mortgage rates are expected to remain near historic lows until the economy shows signs of recovery, according to Can-Wise Financial Mortgage Brokerage. The Bank of Canada’s (BoC) current target for the overnight rate is a historic low of 0.25%. According to Ratehub.ca, the best five-year fixed rate today is 2.14%. Canadian home building could drop by as much as 75% and prices could fall up to 25% in oil-producing provinces, according to the Canada Housing and Mortgage (CHMC). After big declines in 2020, they expect starts, sales and prices to begin to recover by mid-2021. They expect prices overall to fall between 9% and 18% and sales to drop by as much as 30% from prepandemic levels before slowly recovering after 2022. There is such a wide range because there is so much economic uncertainty but starts are expected to hit their low point this fall, between a range of 51,435 and 101,492. March Retail Sales Fall 10.0% Retail sales fell 10.0% in March to $47.1 billion after rising to $52.2 billion in February. The decline was the largest on record, and similar to the drop in the US, according to Statistics Canada. Many Canadian retailers shut down operations mid-month and stores that remained open curtailed hours and limited customer traffic. Based on respondent feedback, about 40% of retailers closed their doors for an average of five business days during March. Sales were down in 6 of 11 subsectors, representing 39.2% of retail trade. Retail sales in volume terms declined a record 8.2%. Sales were down in all provinces. Retail sales declined 15.6% in April, according to an advance estimate provided by Statistics Canada, which wanted to weigh in because of the current very fluid environment. Owing to its preliminary nature, this figure should be expected to be revised. Retail Ecommerce Sales Soar The CV19 pandemic caused many Canadian retailers to open or expand their ecommerce platforms in March in response to physical distancing measures and storefront closures. On an unadjusted basis (that is, not seasonally adjusted) retail ecommerce sales were $2.2 billion in March, accounting for 4.8% of total retail trade. This uptick in retail ecommerce was atypical for March and similar to the pattern normally observed at the start of the annual holiday shopping period. On a year-over-year basis, retail ecommerce increased 40.4%, while total unadjusted retail sales declined 9.6%. Retail Notes Lowe’s reported that Canada had negative comp sales for the first quarter, which shaved points off comp sales overall. The Home Depot turned on curbside pickup capability for Ontario essentially overnight when it became the only option to remain operational for more than a month. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

Archives

July 2024

|