|

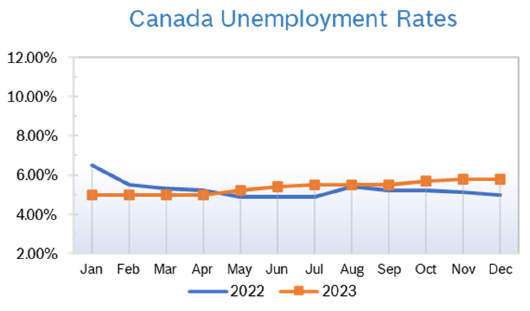

Unemployment Steady at 5.8%

BoC Holds Interest Rates Steady The Bank of Canada (BoC) held interest rates steady at 5% at their meeting in mid-December. The move was widely expected. The BoC raised rates a record-setting ten times since early 2022 in an attempt to slow down inflation but has held them steady since mid-year. The halt to interest rate increases signals that the BoC believes inflation is coming down enough for them to continue to hold steady. However, there was no discussion of an interest rate cut in the immediate future, and the BoC warned that if inflation begins to rise again, so could rates. Consumer Prices Rise 3.1% Consumer prices rose 3.1% year over year in November for the second consecutive month; economists had been expecting a slight decline. Seasonally adjusted prices rose 0.1% from October; economists had been expecting a small decline. However, various core measures continue to moderate, a sign that inflation is slowing. Increases in the price of services pushed up the overall index, with rents up 7.4% year over year. The BoC stressed that there has not been enough progress for them to consider cutting rates anytime soon. Housing and Construction News Canadian housing starts fell 22% in November to 212,624 units, down from 272,264 in October. Starts decreased for both multi-unit and single-family-detached projects, according to the Canadian Mortgage and Housing Corporation (CMHC). Starts on single detached dwellings fell 7% to 44,066 units in November. Big urban centers, where costs are higher, are really struggling, and multi-unit builders are having trouble getting financing. Economists have been expecting starts to fall. Canadian home sales fell 0.9% in November and were down 0.9% from November 2022, according to the Canadian Real Estate Association (CREA). It was the fifth consecutive monthly decline for existing home sales. The actual national average price of a home sold in November was $646,134, up 2% from November 2022. GDP Flat in October The economy remained flat in October for the third consecutive month as services-producing industries inched up 0.1% while goods-producing industries were unchanged, according to Statistics Canada. Statistics Canada says that for October, the manufacturing sector declined 0.6% and wholesale trade contracted 0.7%, while retail trade grew 1.2% and mining, quarrying and oil and gas extraction saw a 1.0% gain. Statistics Canada forecast real GDP for November increased 0.1%, with estimated gains in manufacturing, transportation and warehousing, and agriculture, forestry, fishing and hunting partially offset by decreases in retail trade. Retail Sales Rise 0.7% Retail sales increased 0.7% in October to $66.9 billion after falling to $66.5 billion in September. Sales were up in four out of nine subsectors, led by increases at motor vehicle and parts dealers. Core retail sales, which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers, were down 0.3% for the second consecutive month. In volume terms, retail sales increased 0.3% in September. The largest decrease to core retail sales in October came from building material and garden equipment and supplies dealers, where sales fell 0.2% Sales were up in all provinces except for Alberta. Retail Ecommerce Sales Rise 1.8% On a seasonally adjusted basis, retail ecommerce sales were up 1.8% to $3.9 billion in October, accounting for 5.9% of total retail trade, compared with 5.8% in September. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

Archives

July 2024

|