|

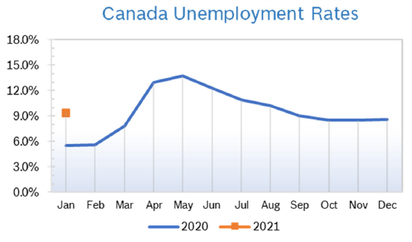

Unemployment Rises to 8.6%

Consumer Confidence Rises to 85.8 The Index of Consumer Confidence rose 11.7 points to 85.8 in December after remaining at 74.1 in November, according to the Conference Board of Canada. It was the highest reading in eight months, as hopes that vaccines will soon be widely available fueled optimism. The index remains well below the peak of 120.6 reached in February 2020. The monthly Index of Consumer Confidence is constructed from responses to four attitudinal questions posed to a random sample of Canadian households. Consumer Prices Rise 1.0% The Consumer Price Index (CPI) rose 1.0% on a year-over-year basis in November after rising 0.7% in October. On a seasonally adjusted monthly basis the CPI rose 0.3% in November after rising by the same percentage in October. Prices rose year over year for six of the eight major components. Statistics Canada noted that restrictions encouraging Canadians to stay home may have contributed to an increase in spending on big-ticket items for the home. Mortgage costs are falling, and gasoline prices remain low. Regionally, prices rose in all provinces. The homeowners' replacement cost index, which is derived from the price of new homes, rose 1.1% in November, the ninth consecutive monthly increase. Despite the increase, economists expect inflation to remain below the Bank of Canada’s (BoC’s) target of 2%. Economists noted that despite the rebound, prices have a long way to go to recover. For the year, the Conference Board now expects consumer prices to rise just 1.1%. GDP rises 0.4% GDP grew 0.4% in October and early estimates suggest that growth continued in November, according to Statistics Canada. October’s increase marked the sixth consecutive month of growth and was slightly above analysts’ estimates. Both goods-producing and services-producing sectors were up overall in October, but many sectors were affected by public health restrictions being reimposed in order to attempt to contain surging pandemic cases. Manufacturing was a drag on the economy, dropping 0.8% after five months of growth. Dining and lodging remain the hardest hit sectors, 31% and 44% below their February levels. While the gain in GDP was small, analysts said it was a good indication that the economy is able to keep churning ahead. Interest Rates Hold Steady at 0.25% The Bank of Canada (BoC) says it will hold key interest rates at 0.25% until economic slack is absorbed so their target of 2% inflation can be achieved and sustained. They will also maintain their quantitative easing program by continuing to buy about $4 billion in bonds every week to try and further reduce interest rates. The BoC also announced they could potentially drop the benchmark rate below its current setting, but emphasized they remain “deeply skeptical” of negative interest rates. The senior deputy governor of the BoC, Carolyn Wilkins, left after nearly 20 years with the institution. A search is underway to find her successor as the bank’s second in command. Housing and Construction News The annual pace of housing starts rose 14.4% in November to a seasonally adjusted annual rate of 246,033 after rising 35% in October. After two consecutive months of declines, multifamily starts picked up and single-family construction remains strong. Canada Mortgage and Housing Corp expects housing starts to remain elevated through next year, as issuance of permits has remained strong and mortgage rates are low. Canada’s home sales slipped 1.6% from October to November, reflecting fewer transactions in about 60% of all local markets, especially in large markets, including Toronto, Vancouver, Montreal and Ottawa. Sales were up 32.1% from November 2019, the same year-over-year increase as in October. More than 500,000 homes have changed hands this year, up 10.5% from the first 11 months of 2019. Despite the fact that inventory is at a historic low of just 2.4 months’ supply, 2020 is on track to be a record year for home sales in Canada. Year-over-year prices are up in double-digits for most areas. Mortgage rates are expected to remain low. Canada’s average home price is expected to jump 9% next year, according to the Canadian Real Estate Association (CREA). They predict the pace of sales will slow, rising 7% to 584,000 units. CREA also expects the average selling price to reach $620,400 in 2021 compared with an estimated $568,000 this year. Canadians used to turn to areas outside the major metros to find more affordable homes, but now are driving away from the cities in order to escape CV19, which is driving up prices everywhere. Prices next year are expected to climb in every province. Mortgage Rates Fall Below 1% Lenders are now offering five-year variable rate mortgages of 0.99% for the first time in Canadian history even though news analysts have warned mortgage rates could soon increase. Unlike US homebuyers, Canadians have traditionally favored variable rate mortgages. Retail Sales Rise 0.4% Retail sales rose 0.4% in October after rising 1.1% in September, the sixth consecutive monthly increase since the record decline in April. Core retail sales, which exclude gasoline stations and motor vehicle and parts dealers, rose 0.3% as sales rose in several home-related categories, including building materials and garden equipment and supply dealers, where sales were up 2.9%. Retail sales were up in 6 of 11 subsectors, representing 50.9% of retail trade, down from 93.2% in September. In volume terms, sales were up 1.1% in September. Sales were up in six provinces, but fell in Ontario and New Brunswick, most likely due to more stringent measures to combat the spread of CV19. Note: Canadian retail sales do not include spending on food services. Retail Ecommerce Sales On an unadjusted basis, retail ecommerce sales reached $3.1 billion in October, accounting for 5.2% of total retail trade. The share of ecommerce sales out of total retail sales fell 0.3% from September, but was up 1.8% year over year. Retail ecommerce sales were up by two-thirds (+67.7%) year over year in October, while total unadjusted retail sales increased 9.1%. When adjusted for basic seasonal effects, retail ecommerce declined 5.0%. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

Archives

July 2024

|