|

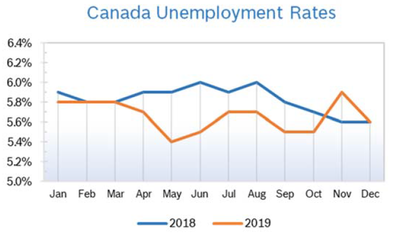

Unemployment Falls to 5.6%

Consumer Confidence Falls to 102.1 The Index of Consumer Confidence fell 9.9 points in December to 102.1 after rising to 112.0 in November, according to the Conference Board of Canada. It was the lowest level for consumer confidence in 36 months. The monthly Index of Consumer Confidence is constructed from responses to four attitudinal questions posed to a random sample of Canadian households. Consumer Prices The Consumer Price Index (CPI) rose 2.2% year over year in November after rising 1.9% in each of the previous three months, according to Statistics Canada. Excluding gasoline, the index was up 2.3% year over year for the second consecutive month. On a seasonally adjusted annual basis the index rose 0.1% in November after rising 0.3% in October. In every province except British Columbia, prices rose more in November on a year-over-year basis compared to October. Higher year-over-year gasoline prices were the largest contributor to the increase everywhere but in British Columbia, where gasoline prices declined due to a surplus of fuel in the Pacific Northwest. GDP Falls 0.1% Canadian GDP fell 0.1% in October after rising 0.1% in September, according to Statistics Canada. Economists had expected GDP to grow 0.1%. The slowdown included a 1.1% drop for retail sales, the largest month-to-month decline in retail sales since March 2016, as well as significant declines in wholesale sales and manufacturing. Eight of 10 subsectors reported lower output in October. GDP Forecast The Bank of Canada (BoC) forecasts that real GDP will grow by 1.5% in 2019, 1.7% in 2020 and 1.8% in 2021. Measures of inflation are all around 2%, with CPI inflation dipping temporarily in 2020 as the effects of a spike in energy prices fade. Bank of Canada Leaves Interest Rates Unchanged at 1.75% The Bank of Canada left its key interest rate unchanged at 1.75% at its last meeting of the year and gave no evidence that a cut in rates is being considered for the near-term future. According to BoC, trade conflicts remain the greatest risk, but the economy has been resilient and the slowdown in the third quarter was expected. Housing and Construction News The annual pace of housing starts rose 0.3% in November to 201,318 units, even though starts declined in Ontario, P.E.I., Quebec, Manitoba and Saskatchewan. Starts rose briskly in British Columbia and also increased in Alberta. The six-month moving average of monthly seasonally adjusted starts was 219,047, up from 218,253 units in October. The pace of urban starts rose 0.4% in November to 188,559 units. Canada’s home sales rose 11.3% in November to a total of 37,213 homes, thanks to a major rebound in sales in the Greater Vancouver area and continued growth in Greater Toronto and Montreal. Sales declined in the Prairie cities of Calgary, Edmonton and Regina, according to the Canadian Real Estate Association (CREA). Nationally there was 4.2 months of inventory, the lowest level since summer 2007 and well below the average of 5.3 months. CREA expects home sales to rise 8.9% in 2020 to 530,000 units and forecasts the average price will rise 6.2% to $531,000. They expect sales will benefit from job growth and population gains and also get a modest boost from government programs for first-time home buyers. Home sales were almost 20% above the six-year low reached in February of this year but are still 7% below highs reached in 2016 and 2017 before mortgage regulations were tightened. Inventory was at a 4.4-months’ supply, the lowest level since April 2017. Retail Sales Retail sales decreased 1.2% to $50.9 billion in October. The decline was primarily due to lower sales at motor vehicle and parts dealers and a 3.1% decline at building material and garden equipment and supplies dealers, the fourth consecutive month sales in this category have fallen. Lower sales were reported in 8 of 11 subsectors, representing 81% of retail trade. After removing the effects of price changes, retail sales in volume terms decreased 1.4%. On an unadjusted basis, retail ecommerce sales were $1.8 billion in October, accounting for 3.4% of total retail trade and were up 14.4% year over year, while total unadjusted retail sales were up 0.8%. Retail Notes Canadian Tire broke ground on a new state of the art distribution center in Brampton, Ontario that is scheduled to open in 2022. Canadian Tire’s 500 physical stores give them an advantage in Canada, according to an interview CFO Dean McCann gave BNN Bloomberg. According to McCann, Canadian Tire’s store network makes it easier for them to compete in all channels, including ecommerce, get products to their customers and offer them options that include in-store pickup and delivery. Canadian Tire’s 500 physical stores give them an advantage in Canada, according to an interview CFO Dean McCann gave BNN Bloomberg. According to McCann, Canadian Tire’s store network makes it easier for them to get products to their customers and to offer the customer options that include in-store pickup and delivery. Lowe’s Canada presented the Salvation Army with a total of 8,680 new toys for their Toys program. It was the first time since the program was launched in 2010 that 35 Rona stores joined forces with Lowe’s stores in Canada to collect toys for underprivileged children of all ages in Ontario, Manitoba, Saskatchewan, Alberta and British Columbia. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

Archives

July 2024

|