|

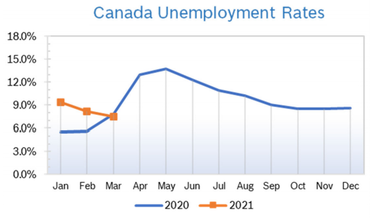

Unemployment Rises to 9.4%

Consumer Confidence Rises to 90.7 The Index of Consumer Confidence rose 4.9 points to 90.7 in January after rising to 85.8 in December, according to the Conference Board of Canada. Consumer confidence improved as the government extended relief payouts and the economy regained some momentum. Compared with its peak, reached in February (120.6), the index is now 29.9 points below its pre-pandemic level. The monthly Index of Consumer Confidence is constructed from responses to four attitudinal questions posed to a random sample of Canadian households. Consumer Prices Fall The Consumer Price Index (CPI) fell unexpectedly to a annual growth rate of 0.7% in December after rising to 1.0% in November. On a seasonally adjusted monthly basis consumer prices fell 0.2% in December; analysts had expected a 0.1% increase. Consumer prices rose at the slowest pace since 2009 in 2020, increasing just 0.7% on an average annual basis, after increasing 1.9% in 2019. Falling transportation and energy prices contributed to the overall decline. Excluding food and energy, overall inflation rose 1.1%. Prices increased in nine provinces. GDP Grows 0.7% in November GDP grew 0.7% in November after growing 0.4% in October, the seventh consecutive monthly gain. GDP was 3% below pre-pandemic levels in February 2020. Both goods-producing (+1.2%) and services-producing (+0.5%) industries were up, as 14 of 20 industrial sectors posted gains in November. Preliminary information indicates an approximate 0.3% increase in real GDP for December. This flash estimate points to an approximate 1.9% increase in real GDP in the fourth quarter of 2020 and to an approximate decline of 5.1% for the year. The retail trade sector grew 1.1% in November and 12 subsectors were up. Building material and garden equipment and supplies grew 3.4%, up for the fourth consecutive month, and non-store retailers rose 3.1% following two months of decline. Construction edged up 0.1% in November. Engineering and other construction activities increased 0.6% and repair activities edged up 0.1%. Partly offsetting these gains was a 0.9% decline in non-residential construction, while residential construction was unchanged in November. Interest Rates The Bank of Canada (BoC) held key interest rates at 0.25% at their first meeting in January, reiterating that they expect the key rate will remain near zero until at least 2023. An accompanying statement noted that the economic recovery in Canada and elsewhere was interrupted by new waves and strains of CV19 infections and new rounds of economic restrictions. The bank also noted that the earlier-than-expected rollout of vaccines has improved the medium-term outlook for growth. They have maintained for some time that they expect the recovery to be choppy and uneven. The central bank said it is maintaining its large-scale asset-purchase program at the current pace of at least $4 billion Canadian dollars each week. Overall, the Bank of Canada anticipates economic growth of 4% in 2021, down slightly from the previous estimate of 4.2% growth. Growth is projected to rise to 4.8% in 2022 and 2.5% in 2023. Housing and Construction News The six-month moving average of housing starts fell 12.2% in December. Multifamily starts fell 15.1% after rising in November. Analysts said some pullback from November’s surge was expected. Despite the drop in December, Canada Mortgage and Housing Corp (CMHC) says the six-month moving average climbed to 239,052 units in December from 236,334 in November. CMHC said that total starts in 2020 surpassed 2019 despite the pandemic, which is remarkable, especially considering restrictions in Quebec that caused construction in the province to grind to a halt in April. CMHC expects housing starts to remain elevated this year, as issuance of permits has remained strong and mortgage rates are low. Home sales rose 47.2% year over year in December, hitting an all-time record for the month and closing out a record year, according to the Canadian Real Estate Association (CREA). It was the largest year-over-year gain in monthly sales in 11 years. Sales for the month were also up 7.2% compared with November. The record-shattering December marked the sixth consecutive month of year-over-year home sales hikes, after the CV19 pandemic led to shutdowns across the country in the key March to May home sales season. For 2020 as a whole, CREA said some 551,392 homes were sold, up 12.6% from 2019, and a new annual record. In December, the seasonally adjusted annual rate of home sales was 714,516, topping 700,000 for the first time. The actual national average home price was a record $607,280 in December, up 17.1% from the final month of 2019. CREA said that excluding the Greater Vancouver and Greater Toronto areas, two of the most active and expensive markets, lowers the national average price by almost $130,000. Inventory was at a historic low of just 100,000 homes at the beginning of January compared to 250,000 in January 2019. Year-over-year prices are up in double-digits for most areas. Mortgage rates are expected to remain low. Semi-rural areas and smaller cities across Canada are seeing record-high home sales as remote work and record-low mortgage rates enable people to go home shopping. Thirty regions in Canada hit record sales from January through November, with most in smaller markets in Ontario, Quebec, Manitoba, New Brunswick and Nova Scotia, according to CREA. Many of the properties being sold were actually built as weekend cottages, so it is likely renovations and expansions to accommodate full-time living will soon follow. Retail Sales Rise 1.3% Retail sales rose 1.3% in November after rising 0.4% in October to $55.2 billion. It was the seventh consecutive monthly increase for retail sales. The increase was driven by food and beverage stores and ecommerce sales. Core retail sales, which exclude gasoline stations and motor vehicle and parts dealers, rose 2.6% on higher sales at food and beverage (+5.9%) and general merchandise (+1.6%) stores, as well as building materials and garden equipment and supplies dealers (+2.2%). Sales were up in 7 of 11 subsectors, representing 53.4% of retail trade. In volume terms, retail sales rose 1.2% in November. Sales were up in nine provinces, led by Quebec and Ontario. Retail Ecommerce Sales Rise On an unadjusted basis, retail ecommerce sales reached $4.3 billion in November, accounting for 7.4% of total retail trade, and up from $3.1 billion in October. The share of ecommerce sales out of total retail sales (7.4%) rose 2.0% from October and was up 3.0% year over year. The rise in sales coincided with retailers urging online shoppers to buy early to avoid shipping delays, as well as promotional events such as Black Friday. Retail ecommerce sales were up 75.9% year over year in November, while total unadjusted retail sales increased 5.8%. When adjusted for basic seasonal effects, retail ecommerce increased 2.7%. Retail Notes A Canadian “Buy Local” program is targeted at driving sales to more than 4,000 independent stores in four cities, Toronto, Calgary, Halifax and Vancouver. The website is called Not Amazon. The program was launched by the owner of a vintage clothing store in Toronto who bought the URL for $2.99. The site now sports hundreds of businesses with websites that offer nationwide shipping, curbside pickup and delivery. So far the website has had more than half a million page views. The site is now submission-based, and the organizer says thousands of businesses are awaiting review and approval. Small and medium-size businesses contribute more than 50% of Canada’s GDP, but since the pandemic 40% of small businesses have reported layoffs and 20% have deferred rent payments. The Canadian Federation of Independent Businesses estimated that one in seven Canadian businesses, or 225,000, will close because of the pandemic. One business owner was surprised to find that 27% of her online shoppers had come through Not Amazon. Business is booming and she is actually hiring more employees and considering expanding. Amazon will open five new sorting and delivery facilities in Quebec that will create more than 1,000 jobs and speed up consumer deliveries. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

Archives

July 2024

|