|

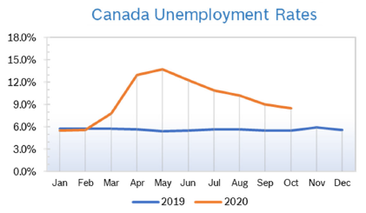

Unemployment Drops to 10.9%

Consumer Confidence Rises to 82.5 Consumer confidence rose 2.8 points in July to 82.5 after jumping 16 points in June to 79.7, according to the Conference Board of Canada. The monthly Index of Consumer Confidence is constructed from responses to four attitudinal questions posed to a random sample of Canadian households. Consumer Prices Rise 0.7% The Consumer Price Index (CPI) rose 0.7% year over year in June after dropping 0.4% in May and 0.2% in April, according to Statistics Canada. Consumer prices were up 0.8% from May to June as the easing of pandemic-containment restrictions triggered rebounds in prices for consumer goods. The biggest bounce-back was gasoline, up 10.5% from May. Excluding energy prices, the CPI was up 0.4% month-over-month. Despite the increase, economists expect inflation to remain tepid, and below the Bank of Canada’s (BoC’s) target of 2%. Economists noted that despite the rebound, prices have a long way to go to recover. Transportation prices contributed the most to the decline, primarily due to lower gas prices, which are expected to remain a drag on Canada’s annual inflation rate. For the year, the Conference Board now expects consumer prices to rise just 1.1%. Statistics Canada and the BOC issued a joint report that they are developing an alternative gauge for inflation that will be capable of capturing the dramatic shifts in consumer buying patterns that have resulted from the pandemic shutdowns. They stated that the standard measure, the consumer price index, has been overstating the decline in prices that consumers have actually experienced. The newly developed analytical price index, as Statistics Canada is calling it, showed a flat reading for April and a slim 0.1% decline for May. The traditional CPI relies on a hypothetical basket of goods and services that Canadians buy every month that is weighted by volume and frequency. Unfortunately many of the items (such as flights, indoor dining, etc.) have been unavailable or very difficult to spend money on while other items (such as hand sanitizer, prepared foods and baking supplies) have become a much higher priority. GDP Grows 4.5% in May Real GDP grew 4.5% in May, according to Statistics Canada. The increase followed two months of unprecedented declines when emergency measures to slow the spread of CV19 resulted in widespread shutdowns. In May, provinces and territories started reopening sectors of their economies to varying degrees. While May's gains offset some of the March and April declines, economic activity remained 15% below February's pre-pandemic level. Both goods-producing (+8.0%) and services-producing industries (+3.4%) were up and 17 of 20 industrial sectors posted increases in May. Statistics Canada issued a preliminary “flash report” for June, stating that GDP likely increased 5% in June, but will decline 12% overall for the second quarter. Estimates will be revised the end of August when the official report for the second quarter is released. Construction rose 17.6% in May with all types of construction activity expanding in the month. The easing of CV19 restriction in May, especially in Ontario and Quebec, contributed to the largest monthly increase since the series began in January 1961.Residential construction increased 20.4% following two months of declines. Gains in multi-unit construction along with home alterations and improvements led the way, more than offsetting lower single-unit construction in May. Interest Rates and Economic Outlook Bank of Canada (BoC) confirmed in July that it will keep the key interest rate at a historic low of 0.25% until the national economic picture improves, which one of the governors said will “take a long time.” The bank’s unprecedented purchase of $5 billion in federal bonds weekly will also continue until the economy recovers. Housing and Construction News The annual pace of housing starts, increased 8% in June to a seasonally adjusted annual rate of 211,681 after falling 20.4% in May, according to Canada Mortgage and Housing Corp. (CMHC). Much of the increased activity took place in Ontario, Canada’s most populated and largest real estate market. Starts in Ontario increased 37% in June to a seasonally adjusted annual rate of 76,341 units. CMHC continues to expect housing starts to fall between 51% an 75% from the first quarter to this fall. The agency has also forecast a decline in home prices of up to 18% from peak, but thus far that has not been the case. Canada’s home sales jumped 63% in June after rising 56.9% in May and were up 15.2% from June 2019 on an unadjusted basis. The number of newly listed properties climbed 49.5% from May to June and available inventory was at a 3.6 months’ supply on a national basis, a 16-year low. Actual sales price was up 6.5% year over year. Mortgage rates are expected to remain near historic lows until the economy shows signs of recovery, according to Can-Wise Financial Mortgage Brokerage. According to Ratehub.ca, the best five-year fixed rate today is 2.14%. May Retail Sales Rise 18.7% Retail sales rose 18.7% to $41.8 billion after falling 24% in April. Motor vehicle and parts dealers led the growth, followed by an increase in sales in 10 out of 11 subsectors. However, sales were 20% below February’s pre-pandemic level. Many retailers went ahead with reopening plans in May, although 23% of retailers remained closed. Retail sales in volume terms were up 17.8% in May, following a record decline of 24.1% in April. Sales were up in every province, led by Ontario and Quebec. Given the rapidly-evolving economic situation, Statistics Canada is providing an advance estimate of June sales. Early estimates suggest that retail sales increased by 24.5% in June. Owing to its preliminary nature, this figure will most likely be revised. Retail Ecommerce Sales Grow The CV19 pandemic led many Canadian retailers to start or expand their ecommerce platforms in April in response to physical distancing measures and brick and mortar store closures, and ecommerce sales were still growing in May. On an unadjusted basis, retail e-commerce sales were $3.8 billion in May, accounting for 8.0% of total retail trade. On a year-over-year basis, retail e-commerce increased 112.7%, while total unadjusted retail sales fell 18.2%.When adjusted for basic seasonal effects, retail e-commerce grew 0.7% in May. Retail Notes Walmart Canada (WMCA) plans to spend $3.5 billion CA ($2.58 billion US) over the next five years to better tie together physical and digital shopping, “reduce payment friction” and make distribution and fulfilment more efficient. Most of the money will go toward distribution centers, including new construction and upgrades. WMCA says the investment will speed up ecommerce for customers and touch every aspect of their business. Walmart will also renovate more than 150 stores over the next three years, about one-third of the stores in Canada. They plan to create a new checkout experience that will reduce touchpoints, along with bigger self checkouts and better mobile payment technology. They are also adding electronic shelf labels and scanners, robotics and computer-vision cameras that will help minimize touch and maximize efficiency and accuracy. They plan to use AI software to more accurately predict and better plan volume. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

Archives

July 2024

|